Why Crypto Is Going Up? Bitcoin And Ethereum Price Rally for 5th Straight Session, XRP, Do

October 27, 2025

Cryptocurrency

markets extended their winning streak for a fifth consecutive session today

(Monday), 27 October 20205, as Bitcoin price surged past $115,000 and Ethereum

reclaimed the critical $4,200 level, with the rally fueled by easing US-China

trade tensions and growing expectations for Federal Reserve rate cuts.

In this

article, I analyze four charts – BTC/USDT, ETH/USDT, XRP/USDT and DOGE/USDT –

drawing on more than 10 years of experience as an investor and technical

analyst to explore why cryptocurrency prices are surging.

Total

cryptocurrency market capitalization climbed approximately 1.9% to $3.92

trillion as investors positioned ahead of the Fed’s October 29 meeting, where

there’s a 98.3% probability of a 25-basis-point rate cut according to

CME’s FedWatch Tool.

|

5-Day Crypto Rally Performance |

Oct 22 Start |

Oct 27 Current |

Gain % |

Key Level Broken |

|

Bitcoin (BTC) |

$111,032 |

$115,956 |

+4.4% |

$114,176 (50-day MA) |

|

Ethereum (ETH) |

$3,950 |

$4,253 |

+7.7% |

$4,070 (August lows) |

|

Total Market Cap |

$3.85T |

$3.92T |

+1.9% |

— |

|

Short Liquidations |

— |

$319M |

— |

24-hour cascade |

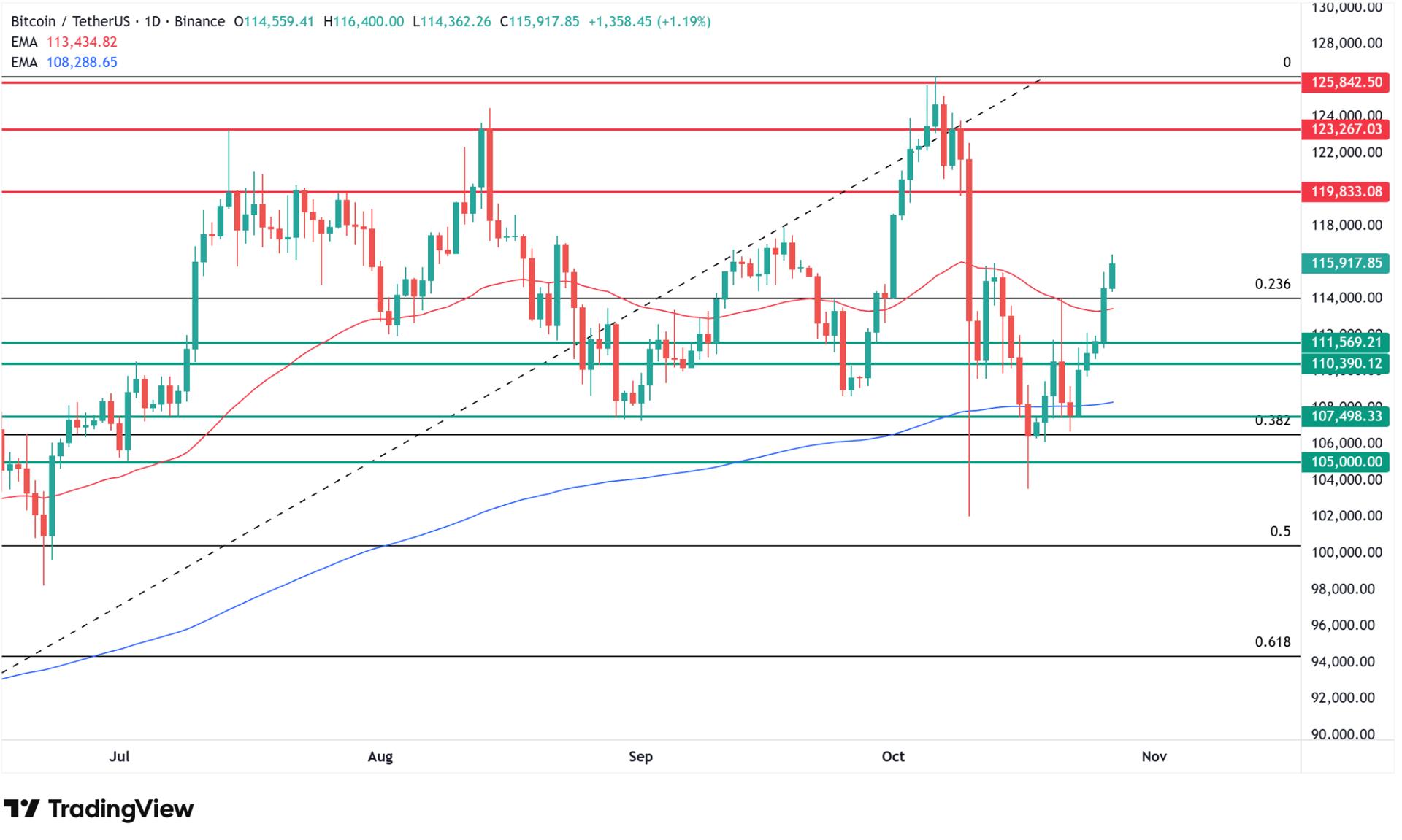

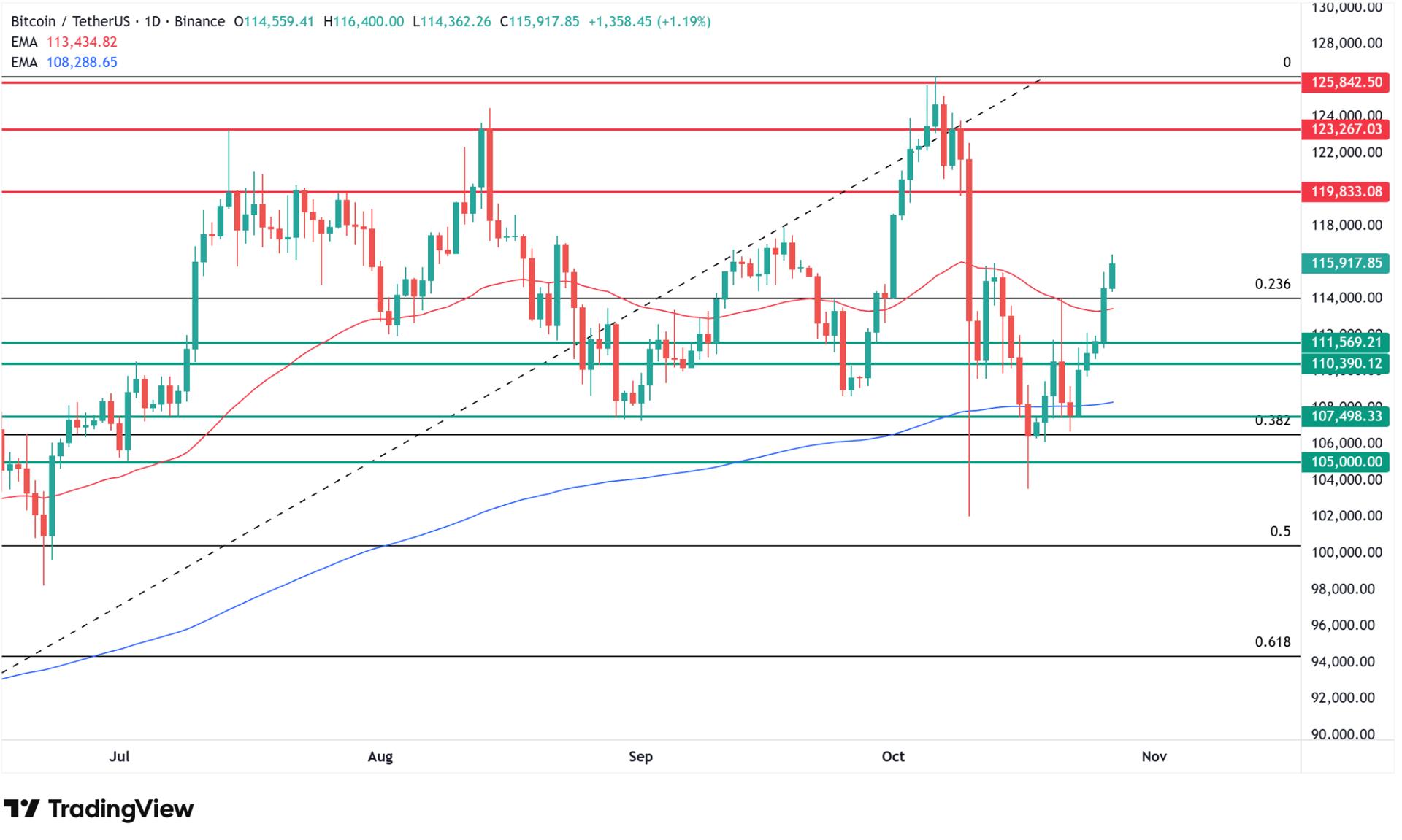

Bitcoin

traded at $115,956 at 8:17 AM CET Monday, gaining 1.22% daily after Sunday’s

2.6% surge that broke through the 50-day exponential moving average at

$114,176. The cryptocurrency has now recovered nearly half of the losses from

the October 10 crash that sent prices tumbling to $103,000, demonstrating

remarkable resilience as bulls target a retest of the $120,000 level.

US-China Trade Framework

Sparks Weekend Rally

The

cryptocurrency surge accelerated over the weekend following the announcement of

a US-China trade framework agreement reached during two days of negotiations in

Malaysia on October 26. US Treasury Secretary Scott Bessent stated that

negotiators achieved a “very substantial framework” that could

prevent threatened 100% US tariffs and secure a pause on China’s rare-earth

export restrictions.

Joel

Kruger, strategist at LMAX, emphasized that “the recent rebound in crypto

has been supported by an improving macro backdrop—particularly softer U.S. CPI

data that has reinforced expectations for Federal Reserve rate cuts and a more

accommodative policy stance.” He added that “together with easing

yields and stronger risk sentiment, this has provided a catalyst for renewed

demand across digital assets heading into year-end.”

I also invite you to check my previous Bitcoin, crypto and metals analyses:

Bitcoin Technical Breakout

Opens Path to $120K

According

to my technical analysis, Bitcoin (BTC) price is climbing for a fifth

consecutive session, with Sunday’s 2.6% gain breaking through the 50-day

exponential moving average at $114,176. Monday’s additional 1% advance

establishes two-week highs at $115,647, with the cryptocurrency reclaiming the

23.6% Fibonacci retracement and opening the path toward a retest of the

psychologically significant $120,000 level marked by July highs.

Breaking

through this $120,000 zone would open the door toward $123,000 and subsequently

$126,000, representing the all-time highs established on August 1 and October 5,

respectively. Although Bitcoin experienced turbulence in early October,

including a single-day 7% decline, the cryptocurrency found support at the

200-day exponential moving average (200 EMA) at $108,639, with a double-bottom

formation providing the platform for the current decisive bounce and return to

upward momentum.

In my view,

Bitcoin could return to price discovery mode before year-end, establishing new

all-time highs and climbing further north.

Derivatives

data from CoinGlass showed $319.18 million in short liquidations over

24 hours through Sunday, indicating bearish positions were squeezed as the

breakout accelerated. Trading volume jumped approximately 318% above session

average during the initial surge past $112,000, confirming genuine buying

interest rather than thin liquidity driving the move.

You may also like: This Trading Giant Who Called Bitcoin’s 2025 Peak Just Made Another Bold 420% Price Prediction

Ethereum Surges Past

$4,200 After Testing 200 EMA

From my

technical analysis of the Ethereum (ETH) price chart, the cryptocurrency is

rising for a fifth straight session, and after a very strong Sunday surge of

over 5%, it added another 2% Monday, testing intraday levels at $4,253. Most

significantly, Ethereum broke above the 50-day exponential moving average (50

EMA) for the first time in over two weeks, returning above the psychologically

important $4,000 level and the resistance marked by mid-August lows.

As a

result, Ethereum now has room to bounce toward this year’s highs drawn around

the $4,800 level, established by August highs and subsequently tested four more

times. A stronger base for Ethereum ‘s rebound was provided by testing the

200-day exponential moving average (200 EMA) and 50% Fibonacci retracement from

the first part of the month, along with local support in the form of a double

bottom drawn in recent weeks around $3,700.

Kruger

noted that “from a technical standpoint, the outlook remains constructive.

The recent pullback in bitcoin and ether appears to be a healthy consolidation

phase following fresh record highs against the U.S. dollar.” He expects

“these markets to remain well supported on dips, paving the way for

another leg higher into year-end.”

XRP Consolidates Below Key

Resistance Despite Rally

Although

XRP is rising for a fifth consecutive session just like Ethereum and Bitcoin ,

according to my technical analysis the chart sits in a somewhat worse position

following strong 15% declines from early October that broke a wedge formation

and entered consolidation at levels last tested in July. Support was

established in the $2.20-$2.35 range, while resistance sits in the $2.60-$2.70

zone, additionally strengthened by the 50 EMA and 200 EMA.

Until XRP

breaks through this resistance zone, in my view, the price remains under

pressure and could decline again to $2.35, or even further toward June lows

around the psychologically round $2.00 level. The cryptocurrency needs to

reclaim the moving average grid and push decisively above $2.70 to invalidate the

bearish technical setup and open the path toward higher targets.

XRP price prediction: This XRP Price Prediction From Ex-Goldman Analyst Eyes $1,000 by 2030

Dogecoin Faces Death Cross

Warning

Dogecoin

(DOGE) price, unlike the cryptocurrencies described above, is not rising for a

fifth consecutive session. However, it gained nearly 5% Sunday and added

another 1% Monday, establishing session highs at $0.2095. This doesn’t change

the fact that price continues consolidating at August levels below an important

resistance zone marked by lows also from that month around $0.21.

It’s worth

emphasizing that the 50-day moving average has practically crossed below the

200 EMA from above, which for technical analysis enthusiasts like myself

represents a very strong signal that could push Dogecoin’s price significantly

lower from current levels. My target downside level would be around

$0.14—representing June 20 lows this year and marking the beginning of the

current cycle for Dogecoin, which extends up to peaks tested in September

around $0.30.

What would

need to happen for me to change my view on Dogecoin? First and foremost,

breaking the current resistance zone and the intraday moving average grid at

$0.22 would be necessary, which would open the path back toward highs toward

the next significant resistance level at $0.25.

Bitcoin Price Prediction: Seasonal

Trends Support Q4 Strength

Kruger

emphasized the importance of historical patterns supporting the current rally.

“We continue to emphasize the importance of seasonal trend analysis, which

remains relevant despite October’s uneven performance so far. Historically,

both October and the broader fourth quarter have delivered strong results for

bitcoin and crypto markets as a whole.”

While

October started with volatility, including the October 10 crash that wiped

billions from the crypto market, “there is still ample time for momentum

to shift—and as we know, a week can be a long time in crypto,” Kruger

noted. The five-day winning streak demonstrates how quickly sentiment can

reverse when catalysts align, particularly with the combination of improving

trade relations, dovish Fed expectations, and technical breakouts converging

simultaneously.

Bitcoin’s

potential targets based on technical projections include $134,100 according

to falling wedge breakout analysis, with critical resistance at $117,600

needing to hold on a daily close basis. A full breakout above that level would

unlock subsequent resistance at $121,400 and $126,300, potentially establishing

new all-time highs before year-end.

Crypto Price Analysis, FAQ

Why is crypto surging for

5 days straight?

Cryptocurrency

markets rallied for five consecutive sessions driven by US-China trade

framework agreement announced October 26 (preventing threatened 100% tariffs),

Federal Reserve rate cut expectations at 98.3% probability for October 29

meeting following weaker-than-expected 3% CPI data, technical breakouts with

Bitcoin reclaiming $114,176 50-day MA and Ethereum surging past $4,200, and

$319.18 million short liquidations creating squeeze dynamics.

Will Bitcoin continue

going up?

Bitcoin

trades at $115,956 after breaking 50-day MA, with technical analysis targeting

$120,000 retest (July highs) then $123,000-$126,000 (all-time high zones),

though LMAX strategist Joel Kruger notes “recent pullback appears to be

healthy consolidation” with markets “well supported on dips, paving

the way for another leg higher into year-end” supported by seasonal Q4

strength historically delivering strong crypto performance.

What’s causing the Ethereum

rally?

Key

catalysts include US Treasury Secretary Scott Bessent announcing “very

substantial framework” with China preventing tariff escalation, September

CPI falling to 3% below 3.1% expected reinforcing Fed dovish stance, softer

yields creating attractive environment for non-yielding assets, technical

breakouts above key moving averages, and structural tailwinds from

institutional adoption and regulatory clarity throughout 2025’s “defining

year for digital assets”.

Is it too late to buy

crypto now?

No. Bitcoin

recovered nearly half of October 10 crash losses but remains 8% below $126,198

all-time high, with analysts targeting $134,100 potential on falling wedge

breakout though critical resistance at $117,600 requires daily close

confirmation, while Kruger cautions markets should be “well supported on

dips” suggesting pullbacks offer entry opportunities, though

cryptocurrency volatility requires careful position sizing and risk management

given rapid five-day advance.

Cryptocurrency

markets extended their winning streak for a fifth consecutive session today

(Monday), 27 October 20205, as Bitcoin price surged past $115,000 and Ethereum

reclaimed the critical $4,200 level, with the rally fueled by easing US-China

trade tensions and growing expectations for Federal Reserve rate cuts.

In this

article, I analyze four charts – BTC/USDT, ETH/USDT, XRP/USDT and DOGE/USDT –

drawing on more than 10 years of experience as an investor and technical

analyst to explore why cryptocurrency prices are surging.

Total

cryptocurrency market capitalization climbed approximately 1.9% to $3.92

trillion as investors positioned ahead of the Fed’s October 29 meeting, where

there’s a 98.3% probability of a 25-basis-point rate cut according to

CME’s FedWatch Tool.

|

5-Day Crypto Rally Performance |

Oct 22 Start |

Oct 27 Current |

Gain % |

Key Level Broken |

|

Bitcoin (BTC) |

$111,032 |

$115,956 |

+4.4% |

$114,176 (50-day MA) |

|

Ethereum (ETH) |

$3,950 |

$4,253 |

+7.7% |

$4,070 (August lows) |

|

Total Market Cap |

$3.85T |

$3.92T |

+1.9% |

— |

|

Short Liquidations |

— |

$319M |

— |

24-hour cascade |

Bitcoin

traded at $115,956 at 8:17 AM CET Monday, gaining 1.22% daily after Sunday’s

2.6% surge that broke through the 50-day exponential moving average at

$114,176. The cryptocurrency has now recovered nearly half of the losses from

the October 10 crash that sent prices tumbling to $103,000, demonstrating

remarkable resilience as bulls target a retest of the $120,000 level.

US-China Trade Framework

Sparks Weekend Rally

The

cryptocurrency surge accelerated over the weekend following the announcement of

a US-China trade framework agreement reached during two days of negotiations in

Malaysia on October 26. US Treasury Secretary Scott Bessent stated that

negotiators achieved a “very substantial framework” that could

prevent threatened 100% US tariffs and secure a pause on China’s rare-earth

export restrictions.

Joel

Kruger, strategist at LMAX, emphasized that “the recent rebound in crypto

has been supported by an improving macro backdrop—particularly softer U.S. CPI

data that has reinforced expectations for Federal Reserve rate cuts and a more

accommodative policy stance.” He added that “together with easing

yields and stronger risk sentiment, this has provided a catalyst for renewed

demand across digital assets heading into year-end.”

I also invite you to check my previous Bitcoin, crypto and metals analyses:

Bitcoin Technical Breakout

Opens Path to $120K

According

to my technical analysis, Bitcoin (BTC) price is climbing for a fifth

consecutive session, with Sunday’s 2.6% gain breaking through the 50-day

exponential moving average at $114,176. Monday’s additional 1% advance

establishes two-week highs at $115,647, with the cryptocurrency reclaiming the

23.6% Fibonacci retracement and opening the path toward a retest of the

psychologically significant $120,000 level marked by July highs.

Breaking

through this $120,000 zone would open the door toward $123,000 and subsequently

$126,000, representing the all-time highs established on August 1 and October 5,

respectively. Although Bitcoin experienced turbulence in early October,

including a single-day 7% decline, the cryptocurrency found support at the

200-day exponential moving average (200 EMA) at $108,639, with a double-bottom

formation providing the platform for the current decisive bounce and return to

upward momentum.

In my view,

Bitcoin could return to price discovery mode before year-end, establishing new

all-time highs and climbing further north.

Derivatives

data from CoinGlass showed $319.18 million in short liquidations over

24 hours through Sunday, indicating bearish positions were squeezed as the

breakout accelerated. Trading volume jumped approximately 318% above session

average during the initial surge past $112,000, confirming genuine buying

interest rather than thin liquidity driving the move.

You may also like: This Trading Giant Who Called Bitcoin’s 2025 Peak Just Made Another Bold 420% Price Prediction

Ethereum Surges Past

$4,200 After Testing 200 EMA

From my

technical analysis of the Ethereum (ETH) price chart, the cryptocurrency is

rising for a fifth straight session, and after a very strong Sunday surge of

over 5%, it added another 2% Monday, testing intraday levels at $4,253. Most

significantly, Ethereum broke above the 50-day exponential moving average (50

EMA) for the first time in over two weeks, returning above the psychologically

important $4,000 level and the resistance marked by mid-August lows.

As a

result, Ethereum now has room to bounce toward this year’s highs drawn around

the $4,800 level, established by August highs and subsequently tested four more

times. A stronger base for Ethereum ‘s rebound was provided by testing the

200-day exponential moving average (200 EMA) and 50% Fibonacci retracement from

the first part of the month, along with local support in the form of a double

bottom drawn in recent weeks around $3,700.

Kruger

noted that “from a technical standpoint, the outlook remains constructive.

The recent pullback in bitcoin and ether appears to be a healthy consolidation

phase following fresh record highs against the U.S. dollar.” He expects

“these markets to remain well supported on dips, paving the way for

another leg higher into year-end.”

XRP Consolidates Below Key

Resistance Despite Rally

Although

XRP is rising for a fifth consecutive session just like Ethereum and Bitcoin ,

according to my technical analysis the chart sits in a somewhat worse position

following strong 15% declines from early October that broke a wedge formation

and entered consolidation at levels last tested in July. Support was

established in the $2.20-$2.35 range, while resistance sits in the $2.60-$2.70

zone, additionally strengthened by the 50 EMA and 200 EMA.

Until XRP

breaks through this resistance zone, in my view, the price remains under

pressure and could decline again to $2.35, or even further toward June lows

around the psychologically round $2.00 level. The cryptocurrency needs to

reclaim the moving average grid and push decisively above $2.70 to invalidate the

bearish technical setup and open the path toward higher targets.

XRP price prediction: This XRP Price Prediction From Ex-Goldman Analyst Eyes $1,000 by 2030

Dogecoin Faces Death Cross

Warning

Dogecoin

(DOGE) price, unlike the cryptocurrencies described above, is not rising for a

fifth consecutive session. However, it gained nearly 5% Sunday and added

another 1% Monday, establishing session highs at $0.2095. This doesn’t change

the fact that price continues consolidating at August levels below an important

resistance zone marked by lows also from that month around $0.21.

It’s worth

emphasizing that the 50-day moving average has practically crossed below the

200 EMA from above, which for technical analysis enthusiasts like myself

represents a very strong signal that could push Dogecoin’s price significantly

lower from current levels. My target downside level would be around

$0.14—representing June 20 lows this year and marking the beginning of the

current cycle for Dogecoin, which extends up to peaks tested in September

around $0.30.

What would

need to happen for me to change my view on Dogecoin? First and foremost,

breaking the current resistance zone and the intraday moving average grid at

$0.22 would be necessary, which would open the path back toward highs toward

the next significant resistance level at $0.25.

Bitcoin Price Prediction: Seasonal

Trends Support Q4 Strength

Kruger

emphasized the importance of historical patterns supporting the current rally.

“We continue to emphasize the importance of seasonal trend analysis, which

remains relevant despite October’s uneven performance so far. Historically,

both October and the broader fourth quarter have delivered strong results for

bitcoin and crypto markets as a whole.”

While

October started with volatility, including the October 10 crash that wiped

billions from the crypto market, “there is still ample time for momentum

to shift—and as we know, a week can be a long time in crypto,” Kruger

noted. The five-day winning streak demonstrates how quickly sentiment can

reverse when catalysts align, particularly with the combination of improving

trade relations, dovish Fed expectations, and technical breakouts converging

simultaneously.

Bitcoin’s

potential targets based on technical projections include $134,100 according

to falling wedge breakout analysis, with critical resistance at $117,600

needing to hold on a daily close basis. A full breakout above that level would

unlock subsequent resistance at $121,400 and $126,300, potentially establishing

new all-time highs before year-end.

Crypto Price Analysis, FAQ

Why is crypto surging for

5 days straight?

Cryptocurrency

markets rallied for five consecutive sessions driven by US-China trade

framework agreement announced October 26 (preventing threatened 100% tariffs),

Federal Reserve rate cut expectations at 98.3% probability for October 29

meeting following weaker-than-expected 3% CPI data, technical breakouts with

Bitcoin reclaiming $114,176 50-day MA and Ethereum surging past $4,200, and

$319.18 million short liquidations creating squeeze dynamics.

Will Bitcoin continue

going up?

Bitcoin

trades at $115,956 after breaking 50-day MA, with technical analysis targeting

$120,000 retest (July highs) then $123,000-$126,000 (all-time high zones),

though LMAX strategist Joel Kruger notes “recent pullback appears to be

healthy consolidation” with markets “well supported on dips, paving

the way for another leg higher into year-end” supported by seasonal Q4

strength historically delivering strong crypto performance.

What’s causing the Ethereum

rally?

Key

catalysts include US Treasury Secretary Scott Bessent announcing “very

substantial framework” with China preventing tariff escalation, September

CPI falling to 3% below 3.1% expected reinforcing Fed dovish stance, softer

yields creating attractive environment for non-yielding assets, technical

breakouts above key moving averages, and structural tailwinds from

institutional adoption and regulatory clarity throughout 2025’s “defining

year for digital assets”.

Is it too late to buy

crypto now?

No. Bitcoin

recovered nearly half of October 10 crash losses but remains 8% below $126,198

all-time high, with analysts targeting $134,100 potential on falling wedge

breakout though critical resistance at $117,600 requires daily close

confirmation, while Kruger cautions markets should be “well supported on

dips” suggesting pullbacks offer entry opportunities, though

cryptocurrency volatility requires careful position sizing and risk management

given rapid five-day advance.

Search

RECENT PRESS RELEASES

NJ Attorney General Accuses Amazon of Discriminating Against Pregnant, Disabled Workers

SWI Editorial Staff2025-10-27T12:00:42-07:00October 27, 2025|

Amazon Is the World’s Biggest Online Book Marketplace. It’s Filled With AI Knockoffs

SWI Editorial Staff2025-10-27T11:59:22-07:00October 27, 2025|

Amazon’s Prime releases trailer for ‘unprecedented’ Paul McCartney documentary

SWI Editorial Staff2025-10-27T11:58:01-07:00October 27, 2025|

iPhone 17 Is a Big Win for Apple

SWI Editorial Staff2025-10-27T11:56:43-07:00October 27, 2025|

MSTR Stock Forecast: Can Strategy Sustain Premium in the Face of Bitcoin Treasury Competit

SWI Editorial Staff2025-10-27T11:54:58-07:00October 27, 2025|

One Bitcoin A Day: Prenetics Raises $48M To Buy Bitcoin

SWI Editorial Staff2025-10-27T11:53:52-07:00October 27, 2025|

Related Post