Why Ethereum Is Lagging Bitcoin—Analysts Cite Inflationary Problems, Dencun Upgrade Blowback, And Solana’s Meme Coins – Grayscale Ethereum Mini Trust (ETH) Common units of fractional undivided beneficial interest (ARCA:ETH)

March 21, 2025

Ethereum ETH/USD, the second-largest cryptocurrency by market capitalization, has charted a diametrically opposite trajectory when compared to its older sibling, Bitcoin BTC/USD, over the past year.

Consider this. Bitcoin has jumped 32% in a year, reaching an all-time high of $109,000. Its share in the overall cryptocurrency market has expanded from 52% to 60%.

Ethereum, on the other hand, contracted 39% during the same time, reducing its market share from 16% to 8%.

The widening gap has sparked discussions about Ethereum’s role in the cryptocurrency hierarchy and its future course Benzinga spoke to a few analysts to understand the factors contributing to the ecosystem’s ongoing downturn.

Jeffrey Hu, Head of Investment Research at digital asset manager HashKey Capital, believed the fault lies in Ethereum’s economic model.

“The activation of EIP-1559 allows more Ether to be burned for deflation when Ether activity is high on Ethereum; however, in order to further support on-chain applications, Ethereum must scale,” Hu stated.

The Ethereum London Hard fork, dubbed EIP-1559, introduced a token burn mechanism for the network. Under this mechanism, the base fee, i.e., the minimum fee per transaction, is removed to add deflationary pressure to ETH and boost its value.

So, what exactly is the problem?

See Also:Bitcoin’s Crisis Paradox Decoded: Bitwise CIO Explains ‘Dip Then Rip’ Phenomenon

Hu asserted that the rise of Layer-2 blockchains and the Dencun Upgrade, which slashed fees on L2s by orders of magnitude, diverted on-chain activity away from the base Ethereum chain, resulting in inflation.

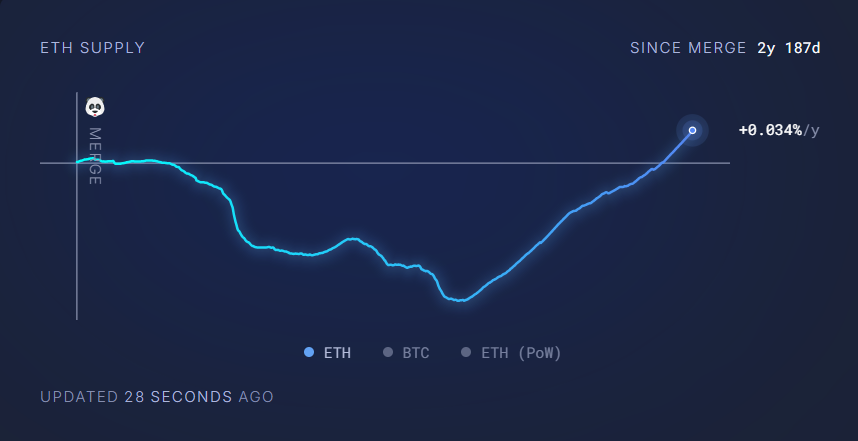

According to Ultrasound Money, ETH’s deflation rate started slowing down in May 2024, and since early February, the coin’s supply has been net increasing.

Trever Koverko, Web3 investor and co-founder of Sapien, echoed these observations.

“Ethereum is struggling to establish a narrative around how L2’s are accretive and not extractive to the main chain,” he added.

However, L2s were not the only competition that Ethereum encountered.

“Ethereum is also not doing well in terms of community culture. In contrast, Solana clearly places more emphasis on meme coin community culture, which has attracted more application development and on-chain transactions,” Hu said.

Over the past year, Solana SOL/USD has indeed become a meme coin hotspot, helped by its user-friendly meme coin generator Pump.fun. In fact, President Donald Trump and First Lady Melania Trump also chose Solana to launch their Official Trump TRUMP/USD and Official Melania MELANIA/USD coins, respectively.

It’s worth remembering that Ethereum remains the only cryptocurrency other than Bitcoin to have its spot exchange-traded fund on Wall Street, however, inflows have been relatively subdued.

Himanshu Maradiya, Founder & Chairman, CIFDAQ Global, stated this is due to a lack of a clear consensus on Ethereum’s narrative.

“Lacking a pure store-of-value proposition and often perceived as the “middle child” of the crypto ecosystem, Ethereum struggles to capture the same institutional confidence,” Maradiya argued.

He also noted that the absence of staking rewards has made Ethereum ETFs less appealing, which may be remedied given that fresh applications have been filed to allow them.

A spokesperson for the Ethereum Foundation—a non-profit dedicated to promoting and developing Ethereum-related technologies—declined to comment on ETH’s shrinking market share but said that their focus remained on ecosystem development and research.

Price Action: At the time of writing, Ethereum was exchanging hands at $1,978.99, down 2.17% in the last 24 hours, according to data from Benzinga Pro. Year-to-date, the coin has slipped 41%.

Image via Shutterstock

Read Next:

Don’t miss a beat on the share market. Get real-time updates on top stock movers and trading ideas on Benzinga India Telegram channel.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Search

RECENT PRESS RELEASES

Related Post