Why Investors Shouldn’t Romanticize Bitcoin, From a Financial Planner

December 8, 2025

(Image credit: Getty Images)

“Do you think I should put some money in bitcoin or crypto?” That’s a question I get a lot as a financial planner.

These cryptocurrency conversations tend to swing between two poles.

On one end, you have the “bitcoin is going to zero” crowd that will never believe in deregulated finance, the blockchain or bitcoin itself.

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more – straight to your e-mail.

Profit and prosper with the best of expert advice – straight to your e-mail.

On the other, the “bitcoin replaces every asset” crowd that believe the entire future is built on the blockchain, the U.S. dollar is going away, and cryptocurrencies will replace it all.

Both are emotionally interesting and analytically useless.

My position, as always, is simpler. Treat bitcoin like any other asset class. Look at the data. Evaluate risk. Study correlations. Understand where it fits in a portfolio and where it absolutely does not.

A look at historical data

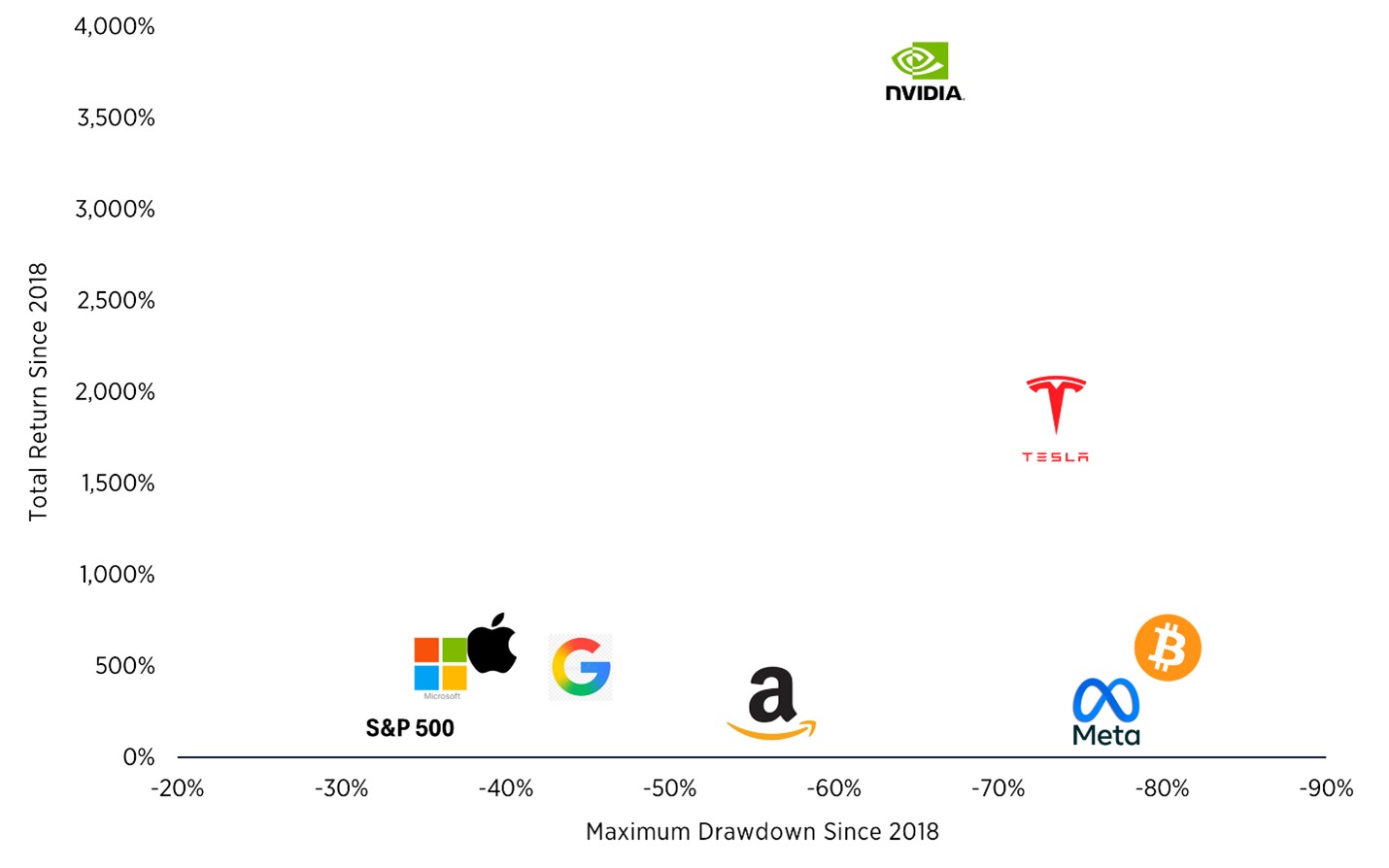

With that lens, I decided to revisit my analysis from 2020, Implications of Adding Bitcoin (Crypto Currencies) to Traditional Portfolios, and look at bitcoin’s (potential) role in a portfolio. I pulled historical price data on bitcoin, the S&P 500 and the Magnificent 7 — Apple (AAPL), Alphabet (GOOG; GOOGL), Microsoft (MSFT), Amazon.com (AMZN), Meta Platforms (META), Tesla (TSLA) and Nvidia (NVDA).

The numbers tell a much more reasonable story than the headlines.

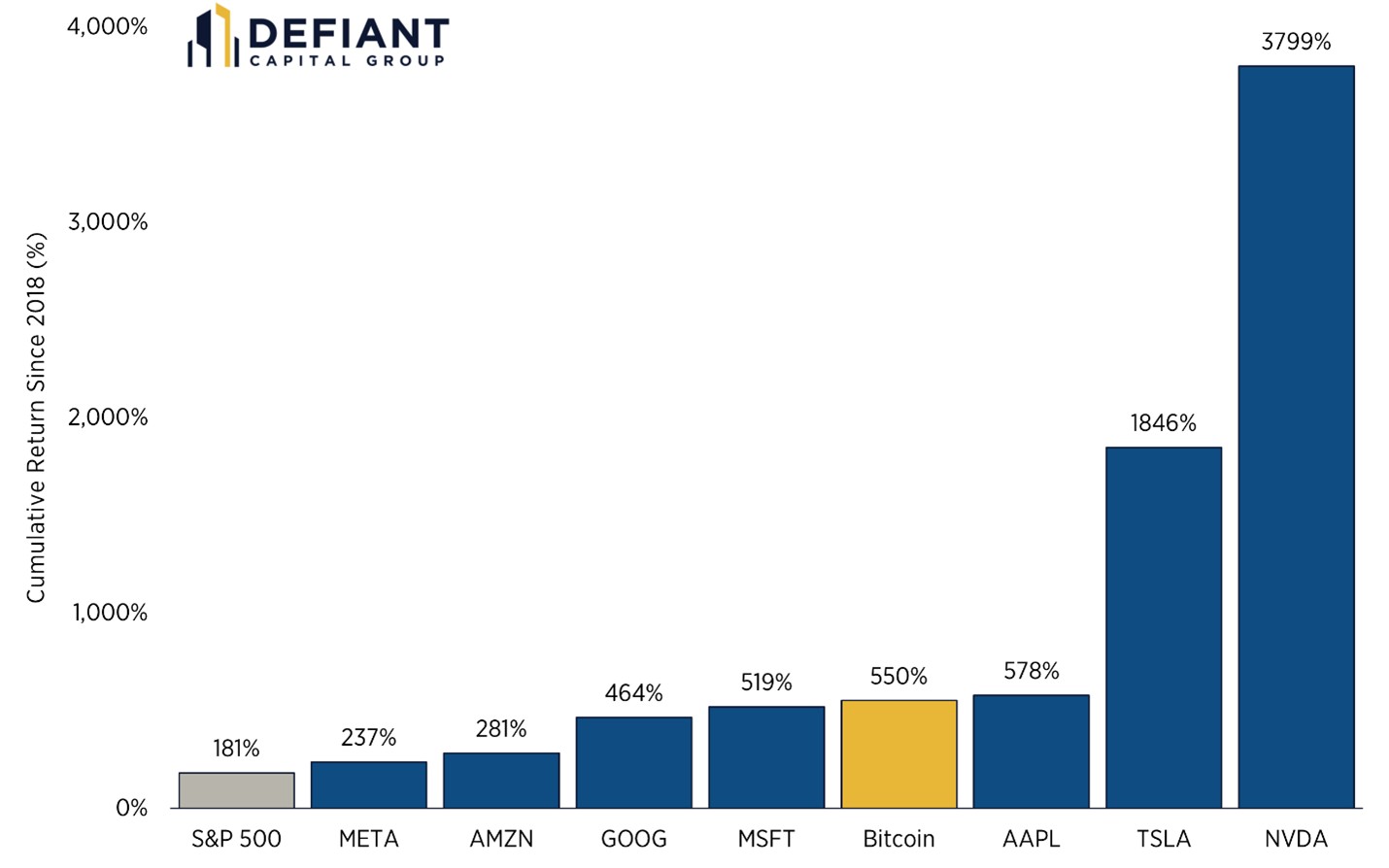

1. Bitcoin’s recent performance looks different than people think

The first thing everyone wants to know is who “won.” On pure returns, bitcoin has outperformed almost everything over longer periods. This is true. It’s also incomplete.

The story is really two parts — bitcoin pre-2018 and bitcoin post-2018.

For the purposes of this analysis, I am looking only at bitcoin post-2018, since its 1,000%+ returns pre-2018 are easy enough to interpret. The question now is: Would you still invest new money today?

Below is a look at annual returns across bitcoin, each Mag 7 component and the S&P 500 since 2018.

I compare bitcoin directly to the Mag 7 because, like crypto, these companies represent high-growth, high-volatility, future-oriented assets that dominate both narrative and performance cycles. If an investor is choosing “the next big thing,” these are the most realistic substitutes.

Source: Koyfin. As of 11/19/2025

A few things jump out from this dataset:

- Bitcoin has delivered several years of triple-digit returns

- Bitcoin has also had multiple calendar years where it fell more than 50%

- The Mag 7, despite massive recent dominance, still look orderly compared to bitcoin’s volatility

- The S&P 500 remains the steady compounder it has always been

So, yes, bitcoin’s long-term return profile is exceptional. But when compared with the Mag 7, those exceptional returns come with extreme volatility, and since 2018, it actually underperforms many of the Mag 7.

The level of volatility relative to return would suggest that the risk premium, or excess return an investor can expect to earn from investing in bitcoin, is not justified. Simply put: Return alone doesn’t settle the question.

If someone tells you only the return, and not the drawdown, they’re leaving out the part that determines whether investors actually stick with an asset.

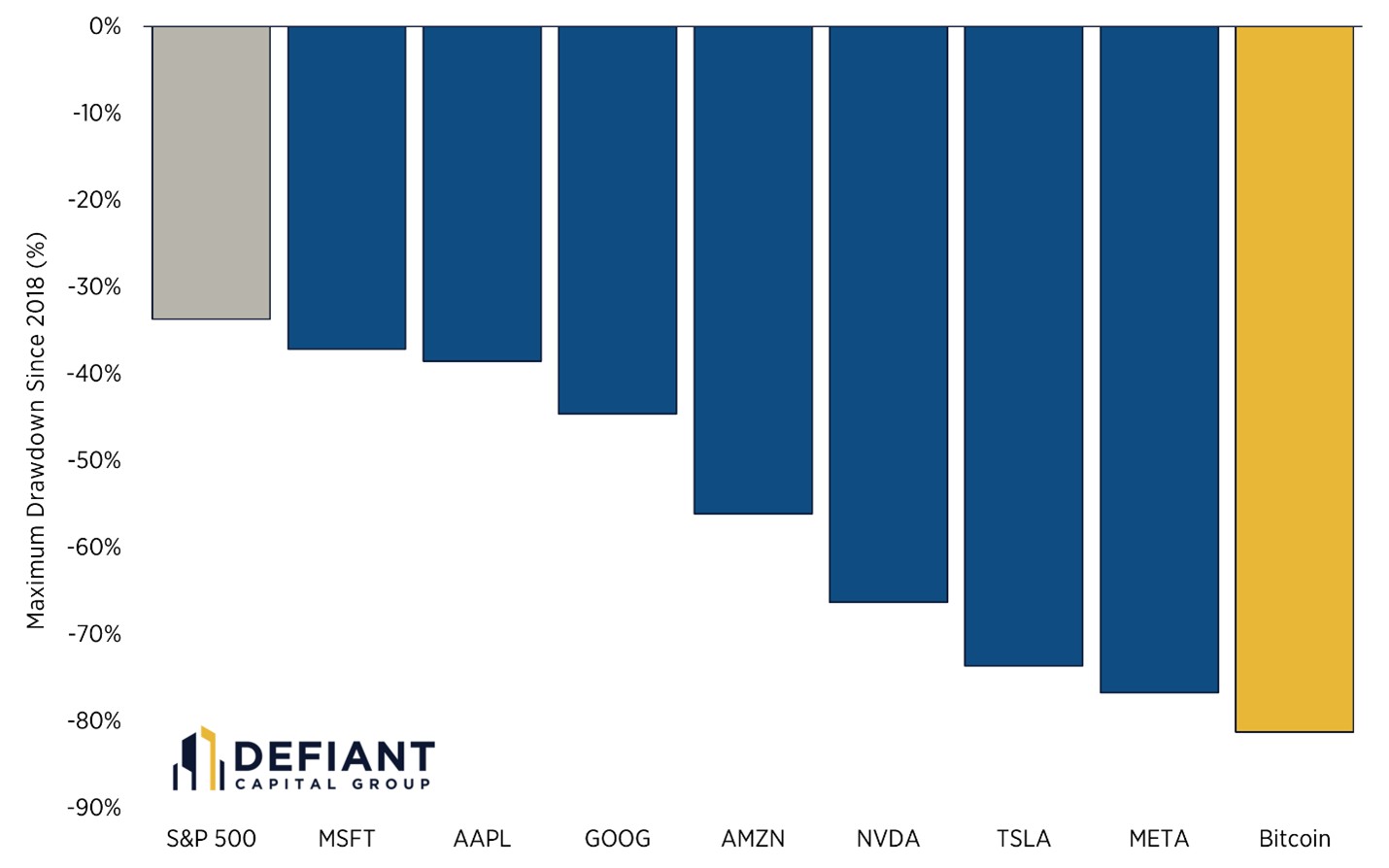

Bitcoin’s drawdowns are not just large — they are violent.

Even mega-cap growth stocks, which are hardly low-risk, don’t draw down as much as bitcoin has experienced. Nvidia, Meta and Tesla have had large drops, but bitcoin has had periods where it lost more than 80% of its value.

This isn’t just an academic point. A portfolio allocation works only if an investor can stay invested. Most people will not hold through an 80% decline, no matter what narrative they believe.

And more importantly, the return (as shown above) has not rewarded investors for holding bitcoin the same way it has for Nvidia, Tesla or even Apple.

In practice, the biggest risk to bitcoin holders isn’t the asset itself — it’s the behavioral failure it induces.

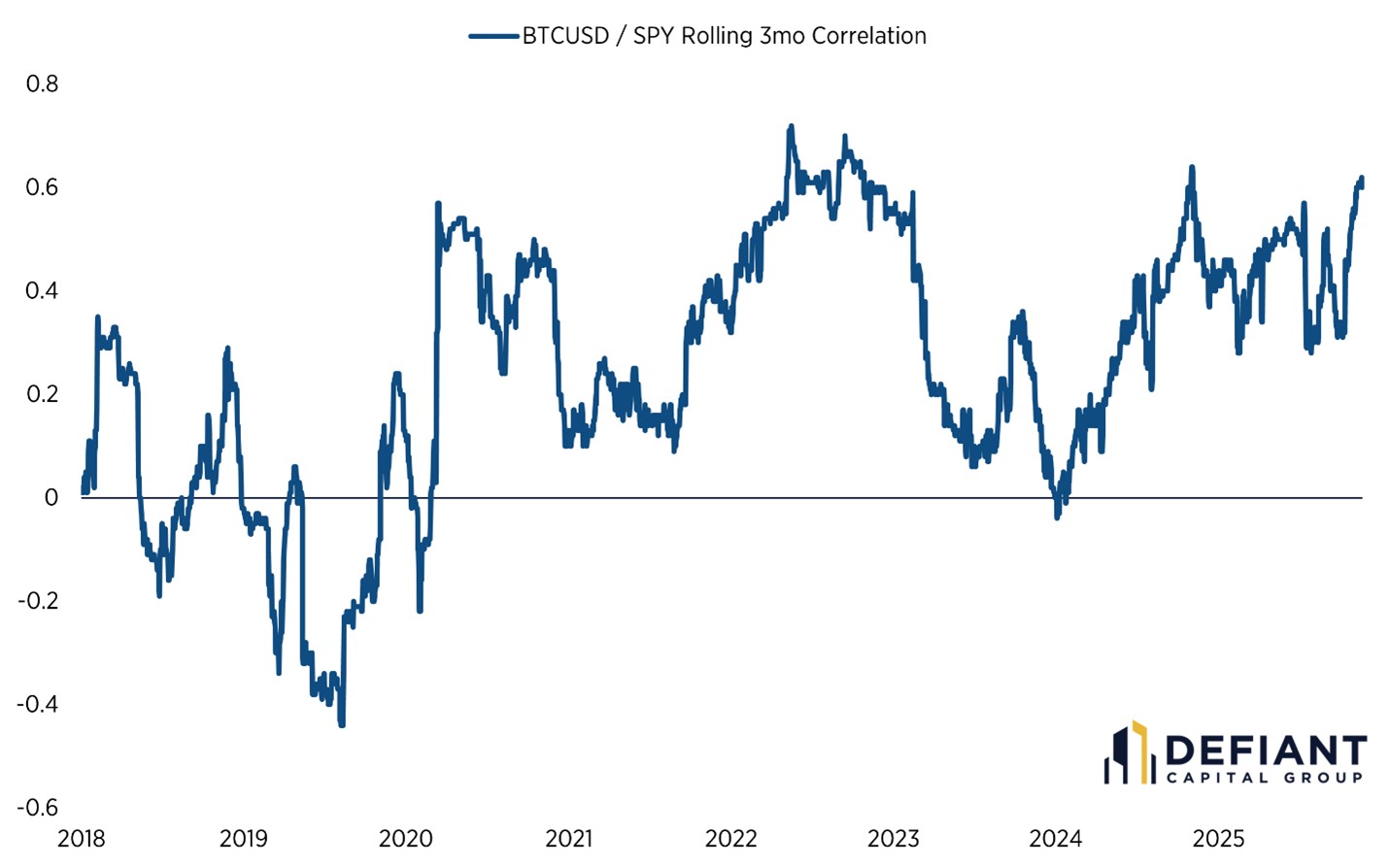

3. Correlations: The case for diversification is more nuanced than people think

One of the strongest arguments in favor of bitcoin is its historically low correlation to stocks. That was true in the early years. It’s less true today.

Using rolling three-month correlations, the relationship between bitcoin and the rest of the market looks very different depending on the period.

A few insights explain most of bitcoin’s behavior:

- Bitcoin increasingly trades like a risk-on asset, not a diversifier

- Correlations rise during periods of market stress, the exact moments investors want diversification to work

- Since 2018, bitcoin has not behaved like “digital gold.” Specifically, whereas gold has a low correlation to the broader market and lower volatility, bitcoin is the oppositive

- Correlations remain unstable across cycles, making forecasting its performance in the future difficult, especially as a risk diversifier

The bottom line: Based on behavior and the way it moves with the broader stock market (e.g. S&P 500), bitcoin is not your portfolio’s insurance policy. It is more like high-beta tech with a different marketing department.

4. So, should bitcoin be in a portfolio?

This is the part where investors expect a binary answer. In my view, it’s not that simple.

I suggest investors think about bitcoin the same way you think about private investments, early venture or any asymmetric risk asset — sizing matters more than prediction.

Regarding the specific role of bitcoin in a portfolio, here’s how we think about it at Defiant Capital Group (as always, this is highly client-specific and it’s not right for all clients):

Potential benefits

Asymmetric upside. The upside tail is real and historically has been meaningful.

Low long-term correlation. Even imperfect diversification can help when position sizes are small.

Rebalancing optionality. Volatility creates opportunities if the investor is disciplined.

Institutional adoption. ETFs and custodial improvements make the asset more investable. As more institutions hold bitcoin and other cryptocurrencies, there is an increasingly stronger and more stable market for it.

Risks that matter

Extreme drawdowns. The path is often worse than the result.

Regime-dependent correlation. Works until it doesn’t.

Speculative flows. Narrative changes drive returns as much as fundamentals.

Behavioral strain. The average investor massively underperforms the asset because they enter and exit at the wrong times.

And for entrepreneurs, who are the bulk of our client base, bitcoin has to be viewed through an even narrower lens.

If most of your wealth already lives in a single business, you don’t need more convexity or more volatility. You need stability, planning and liquidity alignment.

Bitcoin had an incredible rally up to 2017/2018, but since then, the performance has looked more like a high-tech stock. Yes, it can still massively outperform the broader market, but at significantly higher risk.

In our view, bitcoin can play a role in a diversified portfolio, but usually a very small one.

5. A practical allocation framework for bitcoin and crypto

Going straight to the point, here’s the general framework we use with clients:

1. Keep it small. We view investing in bitcoin or other cryptocurrencies like a risky stock investment — there’s high concentration, high risk and the ability for loss. Invest only what you are willing to completely lose.

For most investors, that’s a 1% to 2% investment, which is typically enough to capture the upside without exposing the portfolio to catastrophic drawdowns.

The larger the allocation, the larger the required discipline of the investor.

2. Rebalance regularly. Volatility is only useful if harvested. Without rebalancing, the allocation drifts into a behavioral problem.

3. Match the sizing to the investor’s real risk budget. Look at an investment in bitcoin relative to your existing portfolio and other income streams. Make your allocation in the context of both income and portfolio investments.

4. Understand how bitcoin actually behaves. In our view, bitcoin is no longer a portfolio hedge — its correlation to equity markets is too high, its volatility is closer to that of a mega-cap tech company, and its drawdowns are significantly higher than the broader stock market.

Since 2018, bitcoin has not performed like gold, an inflation hedge or even provided downside protection.

The data simply doesn’t support that story.

Bitcoin’s long-term returns are undeniable. So are its drawdowns. So is its volatility. So is its inconsistent correlation profile.

The most productive way to think about crypto is not as a replacement for traditional assets and not as a guaranteed moonshot. It is an asset with a unique return distribution that can fit into a portfolio if treated with discipline, structure and humility.

At Defiant Capital Group, we don’t dismiss bitcoin. But we don’t romanticize it either. Like anything else in a portfolio, it has to earn its place.

And the way it earns that place is not through prediction, but through design — the same principle that guides everything we build for clients.

Related Content

TOPICS

Get Kiplinger Today newsletter — free

Profit and prosper with the best of Kiplinger’s advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Search

RECENT PRESS RELEASES

Board directs Bellevue Healthcare Trust to limit new investments By Investing.com

SWI Editorial Staff2025-12-08T08:47:12-08:00December 8, 2025|

Zuckerberg backs Yann LeCun’s Paris AI startup

SWI Editorial Staff2025-12-08T08:46:17-08:00December 8, 2025|

Meta launches design studio to “define the next generation of our products”

SWI Editorial Staff2025-12-08T08:45:24-08:00December 8, 2025|

3.86M ETH and Counting — BitMine’s Progress Toward 5% of Ethereum Supply

SWI Editorial Staff2025-12-08T08:44:37-08:00December 8, 2025|

Trump Tariff Whale’s $100M ETH Long Bet as ETH USD Faces Supply Shock: Ethereum Price Pred

SWI Editorial Staff2025-12-08T08:43:58-08:00December 8, 2025|

Update: Last Call for Rhode Island Adult-Use Retail License Applications!

SWI Editorial Staff2025-12-08T08:36:20-08:00December 8, 2025|

Related Post