Why is CA Senator Mike McGuire Trying to Kill the Legal Cannabis Industry?

July 3, 2025

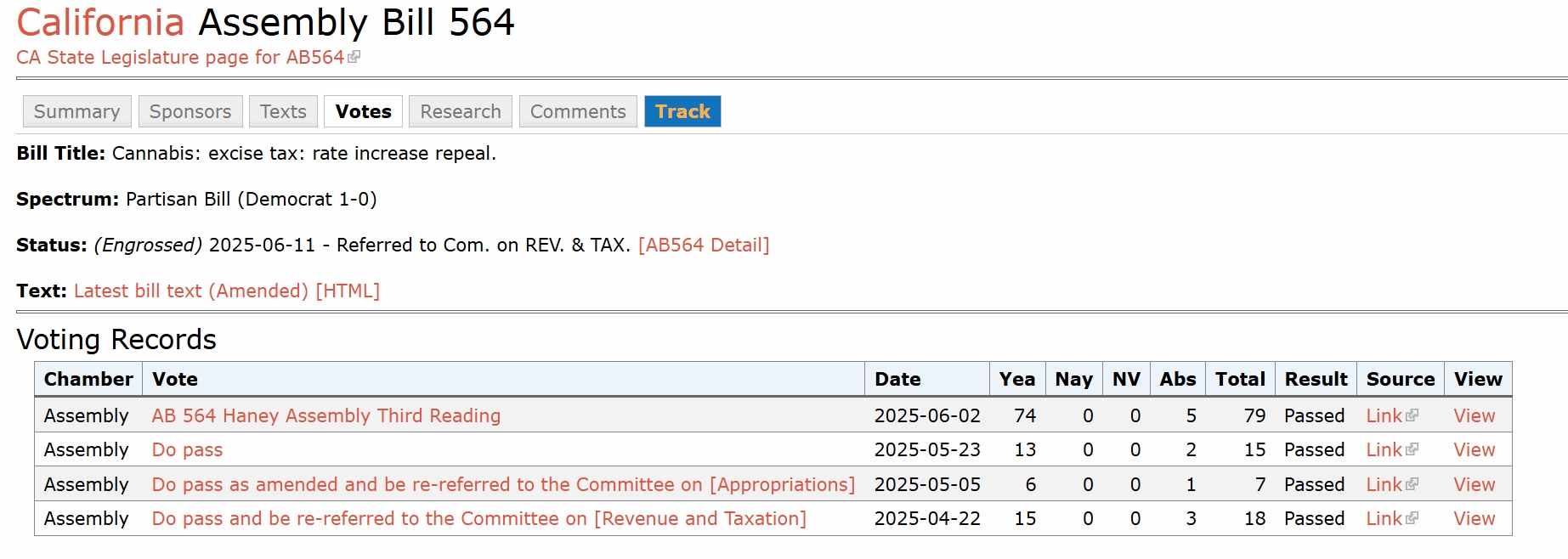

SACRAMENTO, Calif. – California’s legal cannabis industry is under mounting pressure, and in early June, state lawmakers and the governor appeared poised to help. A bill to freeze the state’s cannabis excise tax at 15% sailed through the State Assembly with a unanimous 74-0 vote. The governor’s office backed the plan. And legal cannabis businesses, still struggling to compete with unregulated sellers and mounting operating costs, saw a glimmer of hope.

But in the Senate, the bill stalled.

Senate President Pro Tempore Mike McGuire, who holds significant influence over the flow of legislation, did not advance the bill as part of the budget package, prompting concern from legal operators and local stakeholders in his district and across the state. A scheduled hearing is now set for July 9 in the Senate Revenue and Taxation Committee, offering a critical test of whether the measure will move forward.

McGuire represents the Emerald Triangle, the legendary North Coast region that helps form the backbone of California’s cannabis economy. Almost two-thirds of cannabis licenses are in McGuire’s Senate District. So why would the state’s most powerful senator delay a bill that aimed to protect the legal cannabis businesses in his own backyard?

One possible clue: McGuire is termed out of the Senate and running for statewide office. And his campaigns have been and are being funded in part by industries that compete with or profit from the collapse of legal cannabis.

McGuire himself is a third-generation Northern Californian, whose family farmed grapes in the Alexander Valley for nearly a half-century, according to his official bio. State Sens. Bill Dodd, D-Napa, and McGuire have been co-chairs of the Senate Select Committee on California’s Wine Industry since 2016.

Perhaps more troubling, in late May, McGuire’s campaign accepted more than $5,000 from a Kentucky-based organization lobbying for 7-hydroxymitragynine (7-OH), a metabolite of mitragynine, the most abundant alkaloid found in kratom.

What Is at Stake

The bill in question, Assembly Bill 564, introduced by Assemblymember Matt Haney (D, San Francisco), was designed to stop California’s 15% cannabis excise tax from rising to 19% in July. Under a 2022 law, the state’s excise tax became adjustable to make up for lost revenue after the cultivation tax was repealed.

The state has now raised that rate based on complex revenue formulas.

Legal cannabis businesses warn that the 26.7% overall increase could push more retailers out of business and send more consumers into the unlicensed, unregulated market.

“If we continue to pile on more taxes and fees onto our struggling small cannabis businesses, California’s cannabis culture is under serious threat of extinction,” Assemblymember Haney said when introducing the bill.

“I’ve never experienced collective malaise like this,” Genine Coleman, founder of the Origins Council, which represents small farmers in McGuire’s district, told CalMatters. “People are so concerned with their survival and so deflated. It’s a dangerous space.”

Governor Gavin Newsom’s office supported the freeze. The Assembly passed the bill without a single dissenting vote in committee or on the floor. Yet a hearing in the Senate was not scheduled until after the tax increase took effect on July 1.

A Delay from the Senate Leader

McGuire has not explained his role in slowing the bill’s progress. However, his hesitation has drawn particular scrutiny due to his background. California’s Second Senate District, which includes Humboldt, Mendocino, and Trinity counties, has been cultivating cannabis for generations and was expected to thrive under legalization.

Instead, small growers and dispensaries have been devastated by high taxes, regulatory burdens, falling wholesale prices, and illegal competition from intoxicating hemp, known colloquially as “gas station weed.” Now, with the tax hike already in effect and AB 564 still pending, many are wondering: Why would their own senator hesitate to deliver relief?

Haney is reportedly furious with the delay. “This tax could kill this industry, and there’s still not enough being done,” he said. “California is going to forfeit what should have been a huge opportunity for our state.”

A Campaign Funded by Cannabis Competitors?

McGuire is termed out of the Senate and is running for California Insurance Commissioner in the 2026 election cycle. His new campaign has raised over $2.1 million from 1,412 contributions, many of them from corporate wine and hemp interests with a financial stake in undermining the legal cannabis market.

McGuire’s campaign donors include:

Big Wine – $408,000

Wineries, vintners, wine associations, and associated PACs have contributed more than $400,000 to McGuire’s campaigns.

DoorDash Inc. – $17,000

The food delivery giant has launched a hemp-derived THC category, offering intoxicating products not subject to cannabis regulation or taxation.

Instacart (Maplebear Inc.) – $10,000

Another delivery platform that could profit from looser hemp-based product rules.

American Beverage Association California PAC – $22,300

Beverage companies are eager to expand into cannabis and hemp-infused drinks, especially if cannabis-specific regulations and taxes remain high.

Syngenta Corporation – $3,000

Based in Basel, Switzerland, Syngenta lobbies on hemp production. Syngenta made just one contribution to McGuire on 9/30/2024.

Holistic Alternative Recovery Trust, Inc. – $5,900

A Kentucky-based pro-Kratom organization with minimal revenue and staff made a recent contribution on May 20, 2025, to McGuire. Kratom, a psychoactive stimulant, is marketed as a cannabis alternative and faces virtually no regulation in most states.

All of these donors represent industries that either compete with legal cannabis, benefit from a weakened regulated market, or operate in parallel gray markets that bypass the burdens placed on licensed cannabis businesses.

The Broader Pressure on Legal Operators

Legal cannabis businesses in California face a growing list of challenges:

- An aggregate tax burden as high as 70-80% of the wholesale price

- Strict packaging, advertising, and testing requirements

- No federal tax deductions under IRS code section 280E

- New tariffs on cultivation supplies and hardware

At the same time, intoxicating hemp products like delta-8, THCA, and HHC, often chemically identical to cannabis, are sold online, in gas stations, and through delivery apps with no taxes and minimal oversight.

Kratom, too, is increasingly being promoted as a legal substitute for cannabis. Despite mounting reports of addiction, contamination, and severe side effects, kratom remains unregulated in California. Products are marketed with therapeutic claims, sold alongside hemp-derived intoxicants, and distributed through many of the same delivery platforms.

Legal cannabis businesses say these products undercut them while avoiding every regulation they are required to follow. The FDA has warned against using kratom for medical treatment and says it is “not appropriate for use as a dietary supplement.” Among the reported side effects have been seizures, vomiting, and heart problems.

Kratom has also been involved in a small share of overdose deaths, although most also involved other drugs, analyses have found.

Advocates warn that without intervention, the regulated cannabis market will continue to shrink while the black market grows unchecked.

So, Why the Delay?

This remains unclear.

The governor supports the freeze. The Assembly passed it unanimously. Legal businesses have called it essential for survival. And many of McGuire’s constituents in the Emerald Triangle stand to benefit.

But while the Senate could still pass the bill, lawmakers had ample time to act before the tax increase took effect on July 1. McGuire did not bring it to a vote in time.

Instead, the bill now awaits a hearing in the Senate Revenue and Taxation Committee on July 9 at 9:30 am, while licensed cannabis businesses continue to absorb the added financial burden.

In a statement, McGuire said, “Taxes on California’s overregulated cannabis industry have been a train wreck for years.” However, he warned that freezing the tax would create a budget shortfall. “It’s important to acknowledge that any freeze will create a budget shortfall which would impact critical community programs funded by cannabis tax dollars,” he added.

His position is drawing heightened scrutiny as intoxicating hemp and other unregulated substances continue to flood the market. Critics argue the tax hike is unlikely to protect the programs funded by cannabis revenue. Instead, they warn it will shrink the legal market’s tax base by pushing more consumers toward illicit sellers, ultimately leaving fewer dollars for community programs.

Today, licensed cannabis businesses in California are required to adhere to strict regulations regarding testing, labeling, security, and taxation. At the same time, unlicensed sellers, including national delivery platforms, can market hemp-derived THC and kratom with similar effects, but none of the oversight.

The playing field, legal operators argue, is no longer just uneven; it is untenable.

The stated intent and purpose of Proposition 64, the 2016 initiative to legalize cannabis, was to get rid of the criminal element. It began with the statement: “It is the intent of the People … to take marijuana production and sales out of the hands of the illegal market … to tax the growth and sale of marijuana in a way that drives out the illicit market …”

Whether AB 564 advances on July 9 may determine whether the state intends to keep its legal cannabis system alive or allow it to be priced out of existence.

Search

RECENT PRESS RELEASES

Related Post