Why is crypto down today?

March 28, 2025

- Bitcoin dropped 4% on Friday as core PCE inflation data sparked marketwide sell-off.

- Core PCE in February rose to 2.8% from expectations of 2.7%.

- Top altcoins Ethereum, XRP and Solana also shed gains seen earlier in the week with both crypto and stock markets experiencing a correction.

Bitcoin (BTC) and the crypto market declined on Friday following a rise in February’s core Personal Consumption Expenditure (PCE) data — the Federal Reserve’s (Fed) preferred inflation indicator.

The crypto market witnessed a correction on Friday as macroeconomic data stirred panic among investors. The United States (US) core PCE Price Index, which excludes volatile food and energy prices, rose 2.8% YoY in February, above market expectations of 2.7%.

The combination of high inflation data and President Donald Trump’s tariff threats sparked major losses across the crypto market with Bitcoin plunging 4% below $84,000.

Data from Glassnode reveals that most of the recent selling activity and realized losses in the Bitcoin market largely stem from Short-Term Holders (STH) — investors who have held their BTC for less than 155 days.

This follows a surge in long-term inflation expectations to a high of 4.1% for the first time since 1993. Year-to-date inflation expectations also surged to 5% from 2.6% in the past three months since the beginning of Trump’s tariff announcements, per the latest survey from the University of Michigan.

“Tariff front-running has led to a $300+ BILLION trade deficit in 2 months and consumer sentiment has collapsed,” The Kobeissi Letter stated on X.

The panic in crypto highlights its growing correlation to the stock market, which also saw notable declines after the February PCE data announcement. The S&P 500 is down nearly 2%, wiping over $1 trillion from its market cap. Likewise, the NASDAQ 100 plunged by over 2% on the day.

“The share of consumers expecting higher stock prices over the next 12 months fell 9.3 points in March, to 37.4%, the lowest in a year. This also marks the largest monthly decline since March 2020,” added the Kobeissi Letter.

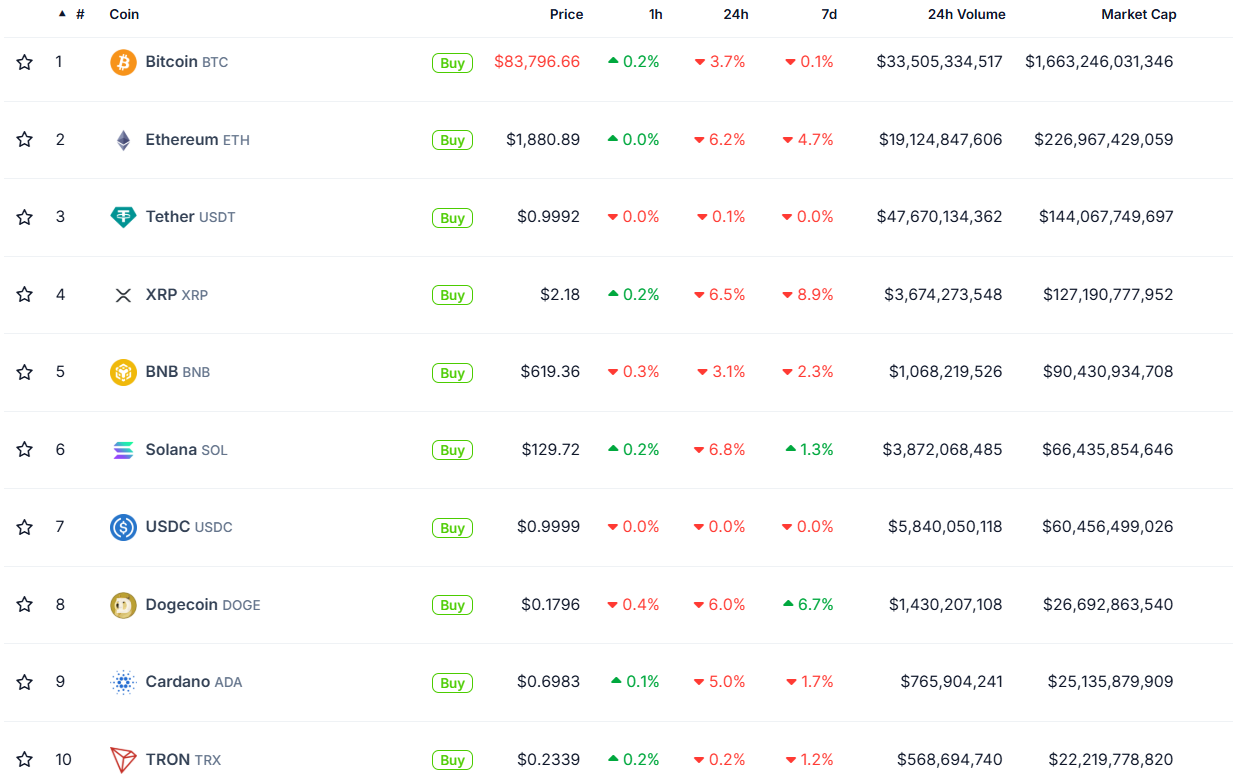

Altcoins were not spared from the crypto bloodbath, with Ethereum (ETH), XRP, Solana (SOL) and Dogecoin (DOGE) wiping out gains seen earlier in the week.

Top cryptos. Source: CoinGecko

Likewise, several major crypto sectors also saw losses, including the artificial intelligence (AI) sector, which has declined over 7% since the market meltdown. Top AI tokens NEAR, Bittensor and Render have declined 10.8%, 10% and 8%, respectively, at the time of publication.

Other sectors witnessing losses include the meme coin and the real-world asset (RWA) sectors, seeing losses of 8% and 5%, respectively.

Share:

Cryptos feed

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Search

RECENT PRESS RELEASES

Related Post