Why Is Crypto Going Down? XRP, Dogecoin, Ethereum And Bitcoin Prices Are Falling Today

July 24, 2025

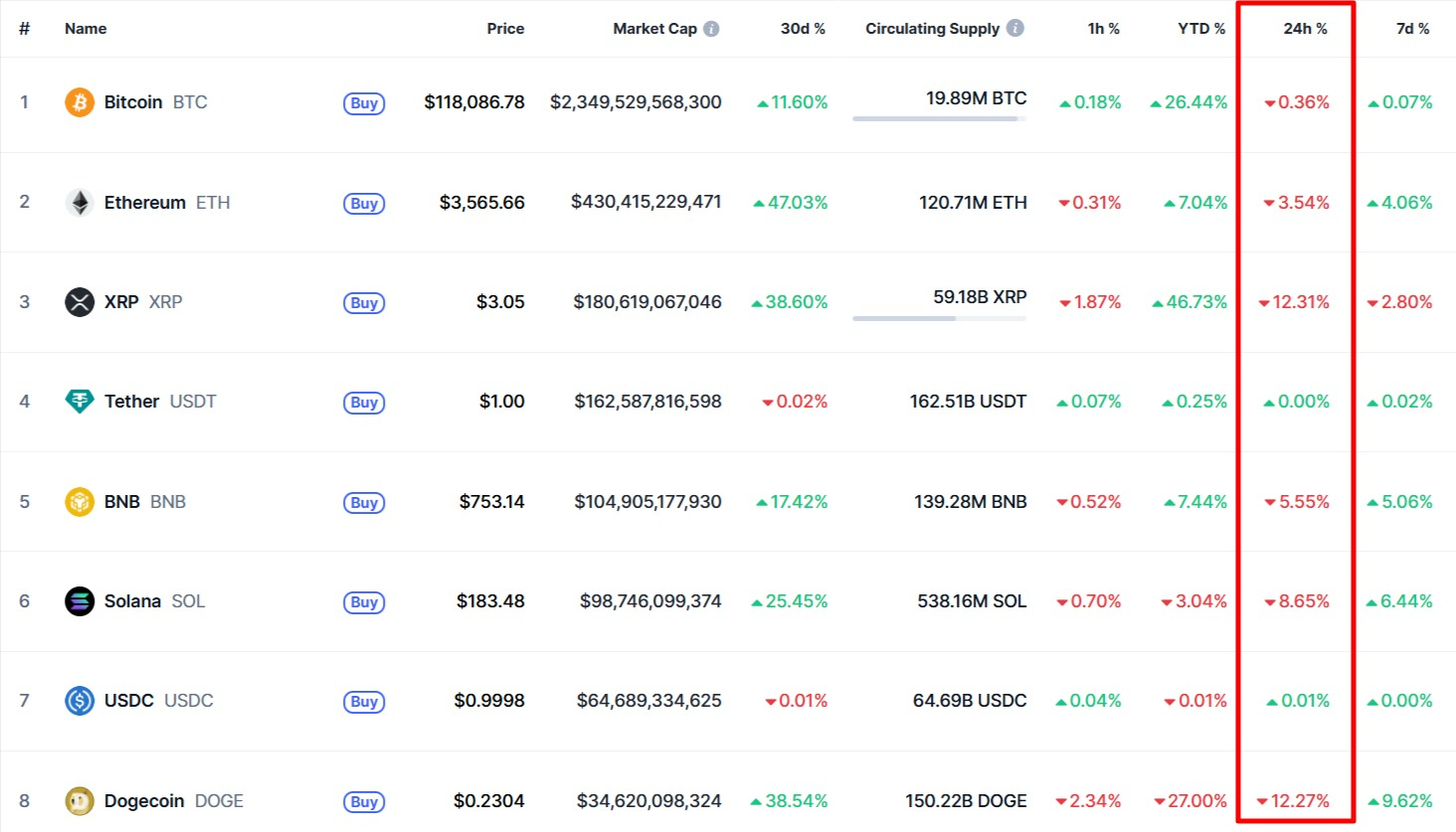

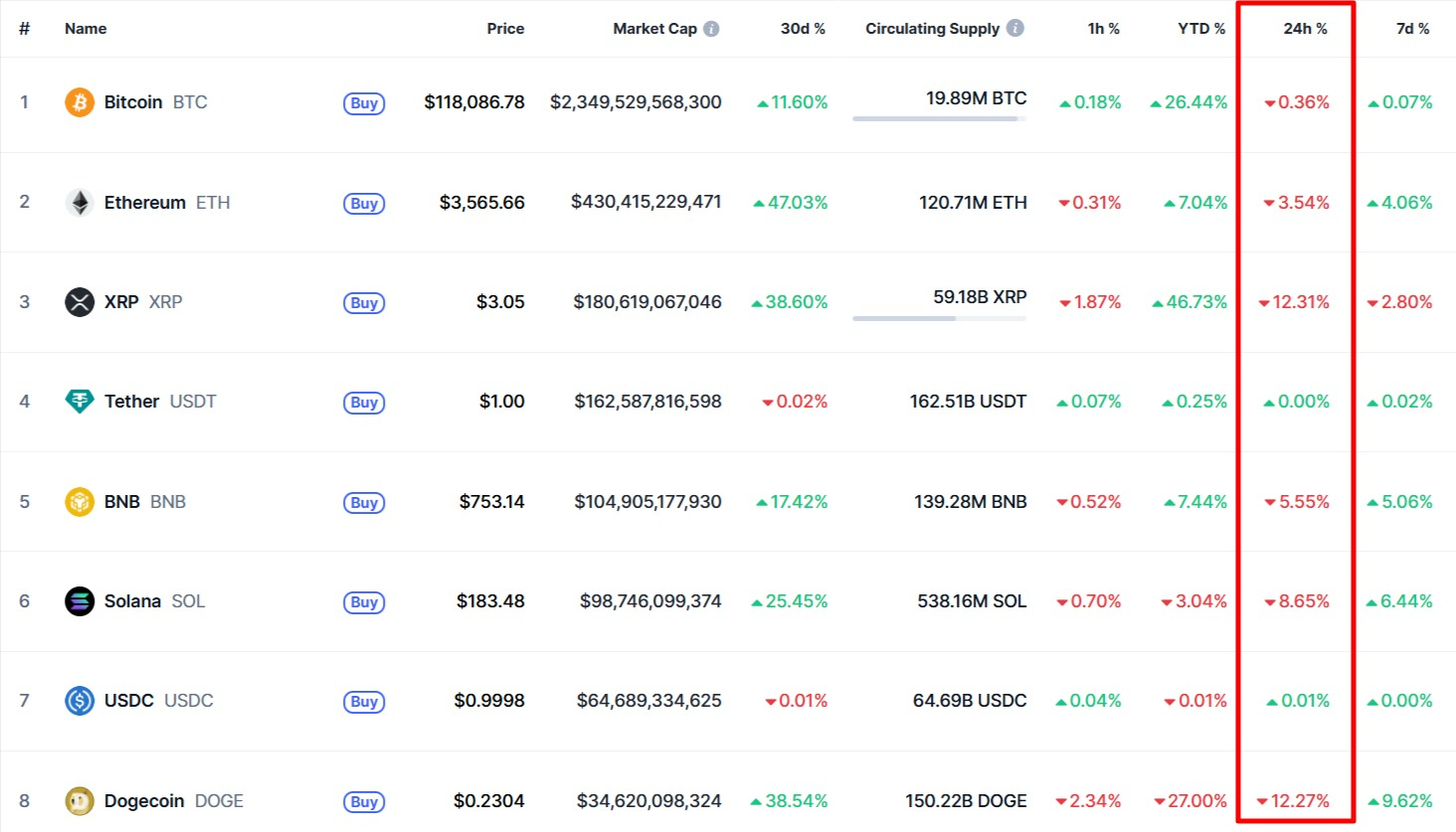

The digital

asset ecosystem is experiencing a dramatic correction as major cryptocurrencies

face intense selling pressure across the board. Bitcoin has retreated 2.3% to

test at $117,142, while Ethereum, XRP, and Dogecoin are suffering even steeper

losses in what traders are describing as a coordinated market selloff driven by

institutional profit-taking and technical breakdowns.

The

cryptocurrency market’s current downturn reflects a perfect storm of factors, including massive validator exits from Ethereum’s staking system, institutional

liquidations, and broader macroeconomic uncertainties that are triggering

risk-off behavior among digital asset investors. Why is crypto going down

today? Let’s check!

Bitcoin (BTC) price has

demonstrated resilience compared to its altcoin counterparts, declining a

modest 2.3% over the past two trading sessions. The world’s largest

cryptocurrency dropped 1% on Wednesday before adding another 1.3% decline on

Thursday, testing intraday lows at $117,142 before recovering slightly to trade

at $117,241.

This

relatively contained decline showcases Bitcoin’s position as a digital safe

haven during periods of cryptocurrency market stress. The asset’s ability to

outperform altcoins during selloffs reinforces its status as the benchmark for

institutional cryptocurrency exposure and retail investor confidence.

My

technical analysis shows that Bitcoin is moving in a consolidation below the

current all-time high, with the closest support at $116,000. The

cryptocurrency’s dominance has increased during this correction as investors

flee riskier altcoin positions for Bitcoin’s perceived stability.

“We will see some continued profit taking at the upper end of this $110,000-$120,000 range,” Paul Howard, Director at Wincent, commented for FinanceMagnates.com. “Volatility is still relatively low, trading around 40, and I believe this low volume environment will persist over the summer. Looking at September expiries, what I expect is a slower period over the next 6 weeks with policy makers away. I would be surprised if BTC breaks out higher and am of the view we consolidate around this band, whilst we can see some rotation and more favorable price moves in $ETH and some of the more speculative Altcoins.”

Ethereum Price Faces

Unprecedented Validator Exit Surge

Ethereum (ETH) price has

experienced the most concerning fundamental developments, declining over 6% as

the network’s validator exit queue reaches an 18-month high. The proof-of-stake

network currently has 644,330 ETH worth approximately $2.34 billion waiting to

unstake, with an 11-day exit queue representing the longest waiting period

since early 2024.

The massive

unstaking activity has pushed Ethereum down 3% on Wednesday followed by another

3% decline on Thursday, testing the crucial $3,515 support level, the lowest

price in over a week. This validator exodus raises questions about whether

large stakeholders are positioning for sales or simply optimizing their staking

strategies.

However, market dynamics remain complex as 390,000 ETH, worth around $1.2 billion, simultaneously wait in the entry queue. This suggests that while some

validators are exiting, others are positioning to enter the staking system,

creating a net unstaking amount of only 255,000 ETH.

The closest

support level currently stands at $3,443, the local highs from November 2024

and late January 2025.

XRP Crashes Through

Critical Support Levels

XRP price has suffered

one of the most severe decline among major cryptocurrencies, plummeting 17%

over two trading sessions. The digital asset fell over 10% on Wednesday before

adding another 7% decline on Thursday, testing the $2.9575 level and breaking

below the psychologically important $3.00 support zone.

Currently

trading at $2.9747, XRP’s breakdown below the $3.00 threshold represents a

significant technical failure that could trigger additional algorithmic

selling. The asset’s correlation with broader market movements has intensified

during this correction period, despite ongoing institutional adoption

initiatives.

In

my latest XRP technical analysis, I mentioned that a drop below $3.00 could

trigger a shift from bullish to bearish scenarios. The current downside target

is the 50-day EMA and the May 2025 high at around $2.60.

The sharp

decline occurred on elevated trading volumes, suggesting institutional

liquidations rather than retail panic selling. Technical indicators point to

potential further downside if XRP cannot quickly reclaim the $3.00 level, with

the next major support zone located around $2.75.

Dogecoin Suffers 18.5%

Crash

Dogecoin (DOGE) price has

experienced the biggest selloff among big altcoins , crashing 18.5% over two

days to test the $0.22 level, its lowest price since mid-July. The meme

cryptocurrency fell nearly 12% on Wednesday before adding another 6.5% decline

on Thursday in what analysts describe as institutional position unwinding.

Trading

volumes exceeded 2.26 billion tokens during the selloff period, marking one of

the highest activity spikes in recent weeks. The massive volume suggests that

large holders are actively reducing their positions, creating sustained

downward pressure on the asset.

The asset’s

extreme volatility during this correction highlights the inherent risks

associated with meme-based cryptocurrencies during broader market stress

periods. Institutional traders appear to be exiting speculative positions to

preserve capital amid uncertain market conditions.

The price

stalled at local highs around $0.28, from which it bounced and quickly returned

below the May resistance at $0.25. The current target is once again $0.20,

where both the 50- and 200-day EMAs converge.

Why Is Crypto Down Today?

Key Market Drivers

The

cryptocurrency market’s current downturn stems from multiple interconnected

factors that have created a perfect storm of selling pressure across

digital assets. Here are the primary drivers behind today’s market decline:

- Market-Wide

Liquidations and Leverage Unwinding – Cascading liquidations have amplified

the selling pressure as over-leveraged positions face margin calls across the

cryptocurrency ecosystem. Institutional and retail traders who accumulated

positions during recent price advances are being forced into additional selling

pressure that extends beyond natural profit-taking activities - Ethereum

Validator Exit Crisis

– $2.34 billion worth of ETH is currently awaiting unstaking through the

validator exit queue, representing the longest waiting period in 18 months. The

validator exit queue has surged to 644,330 ETH with an 11-day wait time,

creating concerns about potential future selling pressure - Institutional

Portfolio Risk Management – Current market movements reflect sophisticated institutional

activity rather than retail panic selling, with coordinated declines

across Bitcoin, Ethereum, XRP, and Dogecoin, Large holders are actively

managing portfolio risk amid broader macroeconomic uncertainties, leading to

strategic position adjustments - Macroeconomic

and Geopolitical Pressures – Global trade tensions and hawkish policy tones have exacerbated

risk-off flows across cryptocurrency markets. Macroeconomic concerns are

triggering institutional repositioning away from higher-risk digital assets

toward more established cryptocurrencies - Speculative

Asset Rebalancing –

Dogecoin’s extreme volatility reflects the risk-off sentiment affecting

speculative positions, with institutional traders reducing exposure to

meme-based assets. Investors are rotating from speculative cryptocurrencies

toward more established digital assets like Bitcoin and Ethereum during periods

of market stress

Crypto Market Outlook and

Price Predictions

- Bitcoin

maintains its position as the institutional favorite with multiple Wall Street firms

publishing increasingly bullish forecasts for the remainder of 2025 and beyond:

Standard Chartered projects Bitcoin reaching $200,000 by year-end 2025,

representing one of the most aggressive mainstream forecasts from a major

banking institution - Ethereum’s

prediction landscape reflects the network’s fundamental technological

advantages and

growing institutional adoption through ETF vehicles: Mark Newton from Fundstrat

targets $4,000 by end of July 2025, with technical resistance levels identified

in the $4,200-$4,500 range. Tom Lee presents ambitious medium-term projections

of $10,000-$15,000 possible by year-end 2025, driven by ecosystem value growth. - XRP

demonstrates strong upside potential driven by regulatory developments and

institutional payment adoption: Standard Chartered maintains the most bullish

mainstream forecast, predicting XRP will reach $5.50 by end of 2025, marking a

potential new all-time high. Michaël Van de Poppe suggests a nearer-term retest

of $3.40 based on technical analysis and bullish momentum patterns - Dogecoin

faces the most challenging prediction environment among major cryptocurrencies, with wide

variance in analyst expectations: Crypto Daily forecasts a range between $0.156

minimum and $0.825 maximum by December 2025

Overall,

the outlook for the four cryptocurrencies covered in this article is strongly

bullish. For a deeper dive, check out my previous analyses of DOGE, XRP,

BTC, and ETH, where I break down expert forecasts for 2025 and beyond, along

with my own technical insights. Don’t miss the details if you’re planning

your next move:

The

cryptocurrency market’s current correction appears to be driven by

profit-taking activities and technical repositioning rather than fundamental

deterioration in the digital asset ecosystem. Historical patterns suggest that

such corrections often precede significant rallies, particularly when driven by

short-term factors rather than structural cryptocurrency issues.

Crypto News, Prices and

FAQ

Why Is Crypto Falling

Down?

The

cryptocurrency market is experiencing a severe correction driven by

unprecedented institutional position unwinding and technical breakdowns across

major networks. The primary catalyst has been Ethereum’s validator crisis, with

$2.34 billion worth of ETH currently awaiting unstaking through an 18-month

high exit queue. This massive validator exodus has created cascading

liquidations exceeding $683 million across leveraged positions, while

algorithmic trading systems amplify selling pressure as key support levels

break down across Bitcoin, Ethereum, XRP, and Dogecoin.

Will Crypto Recover in

2025?

Recovery

prospects for 2025 appear more challenging than previous cycles due to

fundamental shifts in market structure. Unlike past corrections driven

primarily by retail speculation, the current decline reflects sophisticated

institutional repositioning and risk management protocols. However, the

continued growth in Ethereum’s total validator count and the $1.2 billion entry

queue suggest that while some institutions are exiting, others are

strategically positioning for long-term opportunities. The key differentiator

will be whether current validator exits represent profit-taking or genuine loss

of confidence in proof-of-stake mechanisms.

Will Crypto Recover Soon?

Short-term

recovery faces significant headwinds from ongoing institutional deleveraging

and technical damage across major cryptocurrencies. The current correction

differs from typical pullbacks as it involves fundamental infrastructure

stress, particularly within Ethereum’s staking ecosystem. Recovery timing

largely depends on the resolution of the validator exit queue and whether the

$2.34 billion in pending unstaking translates to actual selling pressure or

strategic repositioning. Technical indicators suggest that Bitcoin’s relative

strength may provide market leadership, but altcoin recovery could lag

substantially.

Does Crypto Have a Future?

The

cryptocurrency ecosystem faces a critical evolution phase rather than an

existential crisis. Current market stress is exposing infrastructure

limitations and forcing necessary maturation in staking mechanisms,

institutional risk management, and market structure. While Ethereum’s validator

dynamics create short-term uncertainty, the underlying proof-of-stake

transition represents a fundamental advancement in blockchain efficiency. The

simultaneous growth in both exit and entry queues indicates ongoing institutional

engagement rather than wholesale abandonment of cryptocurrency infrastructure.

Why is Bitcoin Going Down?

Bitcoin’s

decline stems from its correlation breakdown with traditional safe-haven assets

during periods of crypto-specific stress. While Bitcoin has demonstrated

relative resilience compared to altcoins, declining only 2.3% versus

double-digit losses across Ethereum, XRP, and Dogecoin, it cannot escape the

gravitational pull of systematic cryptocurrency market deleveraging. The asset

faces pressure from institutional portfolio rebalancing as traders reduce

overall crypto exposure amid Ethereum’s validator crisis and broader altcoin

weakness, despite maintaining its position as the preferred institutional

cryptocurrency during market stress periods.

The digital

asset ecosystem is experiencing a dramatic correction as major cryptocurrencies

face intense selling pressure across the board. Bitcoin has retreated 2.3% to

test at $117,142, while Ethereum, XRP, and Dogecoin are suffering even steeper

losses in what traders are describing as a coordinated market selloff driven by

institutional profit-taking and technical breakdowns.

The

cryptocurrency market’s current downturn reflects a perfect storm of factors, including massive validator exits from Ethereum’s staking system, institutional

liquidations, and broader macroeconomic uncertainties that are triggering

risk-off behavior among digital asset investors. Why is crypto going down

today? Let’s check!

Bitcoin (BTC) price has

demonstrated resilience compared to its altcoin counterparts, declining a

modest 2.3% over the past two trading sessions. The world’s largest

cryptocurrency dropped 1% on Wednesday before adding another 1.3% decline on

Thursday, testing intraday lows at $117,142 before recovering slightly to trade

at $117,241.

This

relatively contained decline showcases Bitcoin’s position as a digital safe

haven during periods of cryptocurrency market stress. The asset’s ability to

outperform altcoins during selloffs reinforces its status as the benchmark for

institutional cryptocurrency exposure and retail investor confidence.

My

technical analysis shows that Bitcoin is moving in a consolidation below the

current all-time high, with the closest support at $116,000. The

cryptocurrency’s dominance has increased during this correction as investors

flee riskier altcoin positions for Bitcoin’s perceived stability.

“We will see some continued profit taking at the upper end of this $110,000-$120,000 range,” Paul Howard, Director at Wincent, commented for FinanceMagnates.com. “Volatility is still relatively low, trading around 40, and I believe this low volume environment will persist over the summer. Looking at September expiries, what I expect is a slower period over the next 6 weeks with policy makers away. I would be surprised if BTC breaks out higher and am of the view we consolidate around this band, whilst we can see some rotation and more favorable price moves in $ETH and some of the more speculative Altcoins.”

Ethereum Price Faces

Unprecedented Validator Exit Surge

Ethereum (ETH) price has

experienced the most concerning fundamental developments, declining over 6% as

the network’s validator exit queue reaches an 18-month high. The proof-of-stake

network currently has 644,330 ETH worth approximately $2.34 billion waiting to

unstake, with an 11-day exit queue representing the longest waiting period

since early 2024.

The massive

unstaking activity has pushed Ethereum down 3% on Wednesday followed by another

3% decline on Thursday, testing the crucial $3,515 support level, the lowest

price in over a week. This validator exodus raises questions about whether

large stakeholders are positioning for sales or simply optimizing their staking

strategies.

However, market dynamics remain complex as 390,000 ETH, worth around $1.2 billion, simultaneously wait in the entry queue. This suggests that while some

validators are exiting, others are positioning to enter the staking system,

creating a net unstaking amount of only 255,000 ETH.

The closest

support level currently stands at $3,443, the local highs from November 2024

and late January 2025.

XRP Crashes Through

Critical Support Levels

XRP price has suffered

one of the most severe decline among major cryptocurrencies, plummeting 17%

over two trading sessions. The digital asset fell over 10% on Wednesday before

adding another 7% decline on Thursday, testing the $2.9575 level and breaking

below the psychologically important $3.00 support zone.

Currently

trading at $2.9747, XRP’s breakdown below the $3.00 threshold represents a

significant technical failure that could trigger additional algorithmic

selling. The asset’s correlation with broader market movements has intensified

during this correction period, despite ongoing institutional adoption

initiatives.

In

my latest XRP technical analysis, I mentioned that a drop below $3.00 could

trigger a shift from bullish to bearish scenarios. The current downside target

is the 50-day EMA and the May 2025 high at around $2.60.

The sharp

decline occurred on elevated trading volumes, suggesting institutional

liquidations rather than retail panic selling. Technical indicators point to

potential further downside if XRP cannot quickly reclaim the $3.00 level, with

the next major support zone located around $2.75.

Dogecoin Suffers 18.5%

Crash

Dogecoin (DOGE) price has

experienced the biggest selloff among big altcoins , crashing 18.5% over two

days to test the $0.22 level, its lowest price since mid-July. The meme

cryptocurrency fell nearly 12% on Wednesday before adding another 6.5% decline

on Thursday in what analysts describe as institutional position unwinding.

Trading

volumes exceeded 2.26 billion tokens during the selloff period, marking one of

the highest activity spikes in recent weeks. The massive volume suggests that

large holders are actively reducing their positions, creating sustained

downward pressure on the asset.

The asset’s

extreme volatility during this correction highlights the inherent risks

associated with meme-based cryptocurrencies during broader market stress

periods. Institutional traders appear to be exiting speculative positions to

preserve capital amid uncertain market conditions.

The price

stalled at local highs around $0.28, from which it bounced and quickly returned

below the May resistance at $0.25. The current target is once again $0.20,

where both the 50- and 200-day EMAs converge.

Why Is Crypto Down Today?

Key Market Drivers

The

cryptocurrency market’s current downturn stems from multiple interconnected

factors that have created a perfect storm of selling pressure across

digital assets. Here are the primary drivers behind today’s market decline:

- Market-Wide

Liquidations and Leverage Unwinding – Cascading liquidations have amplified

the selling pressure as over-leveraged positions face margin calls across the

cryptocurrency ecosystem. Institutional and retail traders who accumulated

positions during recent price advances are being forced into additional selling

pressure that extends beyond natural profit-taking activities - Ethereum

Validator Exit Crisis

– $2.34 billion worth of ETH is currently awaiting unstaking through the

validator exit queue, representing the longest waiting period in 18 months. The

validator exit queue has surged to 644,330 ETH with an 11-day wait time,

creating concerns about potential future selling pressure - Institutional

Portfolio Risk Management – Current market movements reflect sophisticated institutional

activity rather than retail panic selling, with coordinated declines

across Bitcoin, Ethereum, XRP, and Dogecoin, Large holders are actively

managing portfolio risk amid broader macroeconomic uncertainties, leading to

strategic position adjustments - Macroeconomic

and Geopolitical Pressures – Global trade tensions and hawkish policy tones have exacerbated

risk-off flows across cryptocurrency markets. Macroeconomic concerns are

triggering institutional repositioning away from higher-risk digital assets

toward more established cryptocurrencies - Speculative

Asset Rebalancing –

Dogecoin’s extreme volatility reflects the risk-off sentiment affecting

speculative positions, with institutional traders reducing exposure to

meme-based assets. Investors are rotating from speculative cryptocurrencies

toward more established digital assets like Bitcoin and Ethereum during periods

of market stress

Crypto Market Outlook and

Price Predictions

- Bitcoin

maintains its position as the institutional favorite with multiple Wall Street firms

publishing increasingly bullish forecasts for the remainder of 2025 and beyond:

Standard Chartered projects Bitcoin reaching $200,000 by year-end 2025,

representing one of the most aggressive mainstream forecasts from a major

banking institution - Ethereum’s

prediction landscape reflects the network’s fundamental technological

advantages and

growing institutional adoption through ETF vehicles: Mark Newton from Fundstrat

targets $4,000 by end of July 2025, with technical resistance levels identified

in the $4,200-$4,500 range. Tom Lee presents ambitious medium-term projections

of $10,000-$15,000 possible by year-end 2025, driven by ecosystem value growth. - XRP

demonstrates strong upside potential driven by regulatory developments and

institutional payment adoption: Standard Chartered maintains the most bullish

mainstream forecast, predicting XRP will reach $5.50 by end of 2025, marking a

potential new all-time high. Michaël Van de Poppe suggests a nearer-term retest

of $3.40 based on technical analysis and bullish momentum patterns - Dogecoin

faces the most challenging prediction environment among major cryptocurrencies, with wide

variance in analyst expectations: Crypto Daily forecasts a range between $0.156

minimum and $0.825 maximum by December 2025

Overall,

the outlook for the four cryptocurrencies covered in this article is strongly

bullish. For a deeper dive, check out my previous analyses of DOGE, XRP,

BTC, and ETH, where I break down expert forecasts for 2025 and beyond, along

with my own technical insights. Don’t miss the details if you’re planning

your next move:

The

cryptocurrency market’s current correction appears to be driven by

profit-taking activities and technical repositioning rather than fundamental

deterioration in the digital asset ecosystem. Historical patterns suggest that

such corrections often precede significant rallies, particularly when driven by

short-term factors rather than structural cryptocurrency issues.

Crypto News, Prices and

FAQ

Why Is Crypto Falling

Down?

The

cryptocurrency market is experiencing a severe correction driven by

unprecedented institutional position unwinding and technical breakdowns across

major networks. The primary catalyst has been Ethereum’s validator crisis, with

$2.34 billion worth of ETH currently awaiting unstaking through an 18-month

high exit queue. This massive validator exodus has created cascading

liquidations exceeding $683 million across leveraged positions, while

algorithmic trading systems amplify selling pressure as key support levels

break down across Bitcoin, Ethereum, XRP, and Dogecoin.

Will Crypto Recover in

2025?

Recovery

prospects for 2025 appear more challenging than previous cycles due to

fundamental shifts in market structure. Unlike past corrections driven

primarily by retail speculation, the current decline reflects sophisticated

institutional repositioning and risk management protocols. However, the

continued growth in Ethereum’s total validator count and the $1.2 billion entry

queue suggest that while some institutions are exiting, others are

strategically positioning for long-term opportunities. The key differentiator

will be whether current validator exits represent profit-taking or genuine loss

of confidence in proof-of-stake mechanisms.

Will Crypto Recover Soon?

Short-term

recovery faces significant headwinds from ongoing institutional deleveraging

and technical damage across major cryptocurrencies. The current correction

differs from typical pullbacks as it involves fundamental infrastructure

stress, particularly within Ethereum’s staking ecosystem. Recovery timing

largely depends on the resolution of the validator exit queue and whether the

$2.34 billion in pending unstaking translates to actual selling pressure or

strategic repositioning. Technical indicators suggest that Bitcoin’s relative

strength may provide market leadership, but altcoin recovery could lag

substantially.

Does Crypto Have a Future?

The

cryptocurrency ecosystem faces a critical evolution phase rather than an

existential crisis. Current market stress is exposing infrastructure

limitations and forcing necessary maturation in staking mechanisms,

institutional risk management, and market structure. While Ethereum’s validator

dynamics create short-term uncertainty, the underlying proof-of-stake

transition represents a fundamental advancement in blockchain efficiency. The

simultaneous growth in both exit and entry queues indicates ongoing institutional

engagement rather than wholesale abandonment of cryptocurrency infrastructure.

Why is Bitcoin Going Down?

Bitcoin’s

decline stems from its correlation breakdown with traditional safe-haven assets

during periods of crypto-specific stress. While Bitcoin has demonstrated

relative resilience compared to altcoins, declining only 2.3% versus

double-digit losses across Ethereum, XRP, and Dogecoin, it cannot escape the

gravitational pull of systematic cryptocurrency market deleveraging. The asset

faces pressure from institutional portfolio rebalancing as traders reduce

overall crypto exposure amid Ethereum’s validator crisis and broader altcoin

weakness, despite maintaining its position as the preferred institutional

cryptocurrency during market stress periods.

Search

RECENT PRESS RELEASES

Meta’s Strategic Resurgence of Facebook’s ‘Poke’ Feature: A Gamification-Driven Play to Re

SWI Editorial Staff2025-09-05T02:20:56-07:00September 5, 2025|

Mark Zuckerberg – no, not that one – sues Facebook for account shutdowns

SWI Editorial Staff2025-09-05T02:20:30-07:00September 5, 2025|

Mark Zuckerberg is suing Mark Zuckerberg and it’s not funny

SWI Editorial Staff2025-09-05T02:20:11-07:00September 5, 2025|

Sam Altman, Tim Cook, and other tech leaders lauded Trump at a White House AI dinner

SWI Editorial Staff2025-09-05T02:19:45-07:00September 5, 2025|

Facebook revives classic ‘Poke’ feature with gamified twist

SWI Editorial Staff2025-09-05T02:19:26-07:00September 5, 2025|

Facebook revives the poke, classic feature makes a comeback with new button and poke count

SWI Editorial Staff2025-09-05T02:19:05-07:00September 5, 2025|

Related Post