Why Meta Platforms Stock Fell 12% in October

November 6, 2025

Spending at Meta is going up.

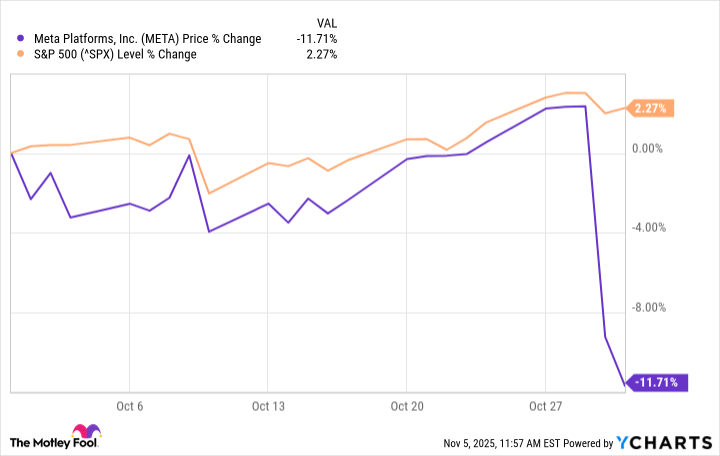

Share prices of Meta Platforms (META +1.43%) were heading lower last month as the stock tumbled following its third-quarter earnings report at the end of the month. Investors seemed to balk at the company’s plans to notably raise capital expenditures next year, sparking some concerns that it was getting too aggressive and adding too much risk. Additionally, Meta’s generally accepted accounting principles (GAAP) profit was much lower than expected due to a one-time, non-cash expense associated with the change in value of a deferred tax asset as the company expects to pay a lower tax rate following the passage of the “big, beautiful bill.”

Prior to the report, Meta overcame an initial sell-off earlier in October, and the stock was trading higher for the month. According to data from S&P Global Market Intelligence, the stock finished the month down 12%.

As you can see from the chart below, Meta plunged sharply after the Oct. 29 report.

Meta’s big disappointment

Meta’s third-quarter earnings report was actually strong. The social media giant reported 26% year-over-year revenue growth to $51.2 billion. That topped estimates at $49.4 billion.

Once again, its growth was driven almost entirely by its advertising business, which continues to soar, benefiting from artificial intelligence (AI)-based improvements, the monetization of Reels, a healthy ad market, and a growing user base and usage time.

On the bottom line, excluding the impact of the charge related to the change in valuation of its deferred tax asset, earnings per share would have risen from $6.20 to $7.25, topping the consensus at $6.71.

Despite the strong adjusted results, the stock still fell 11.4% on the report as the company said its capital expenditure dollar growth would be “notably larger” in 2026, and that total expenses will grow at a “significantly faster percentage rate” next year than they did this year.

That seemed to spook investors, especially as the company is still losing billions a year on Reality Labs.

Image source: Getty Images.

What it means for Meta

It’s unclear if the guidance means that profits will come down next year, but it’s understandable why investors might want to pump the brakes on the stock.

Meta is known for super cycles in capital expenditures, and it looks set to begin another one. CEO Mark Zuckerberg argued that achieving superintelligence is the company’s goal, and he sees it as a worthy one. After all, the stakes are enormous in the AI race, and this is not the time to be cautious about investing in AI capacity.

That’s no guarantee that it will pay off for Meta, but the company can afford it, and its advertising business continues to post blockbuster results. Over the long term, the stock still looks like a buy.

Search

RECENT PRESS RELEASES

Related Post