Why SharpLink Gaming (SBET) Is Down 8.7% After Ethereum-Fueled Q3 Results and $200M DeFi P

November 19, 2025

- SharpLink Gaming reported third quarter results on November 12, 2025, showing a very large increase in sales to US$10.84 million and a move to US$104.27 million in net income, largely attributed to Ethereum treasury strategies and staking activities.

- The company also announced a US$200 million Ethereum deployment on the Linea Layer 2 platform with ConsenSys to enhance decentralized finance yields, underscoring its pivot into blockchain-powered capital management.

- With this significant focus on Ethereum treasury management, we’ll examine how the company’s blockchain initiatives are shaping its investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Advertisement

What Is SharpLink Gaming’s Investment Narrative?

For anyone interested in SharpLink Gaming, the central theme now is how deeply the company is tied to blockchain capital management, especially Ethereum. The impressive shift to profitability in the latest quarter, supported by a massive increase in sales and net income thanks to its Ethereum treasury staking strategy, has created a short-term catalyst not seen in prior periods. The new US$200 million ETH deployment into the Linea Layer 2 platform, alongside expanded partnerships, could draw fresh attention to SharpLink’s blockchain ambitions and improve its position in decentralized finance. At the same time, the major risk is heightened volatility driven largely by cryptocurrency markets, sharp swings in short interest, and substantial shareholder dilution from recent equity offerings. These factors can quickly shift sentiment, and the company’s shift away from its core gaming roots adds another layer of operational uncertainty for investors to weigh.

But market fluctuations and crypto dependencies could bring unexpected surprises for shareholders.

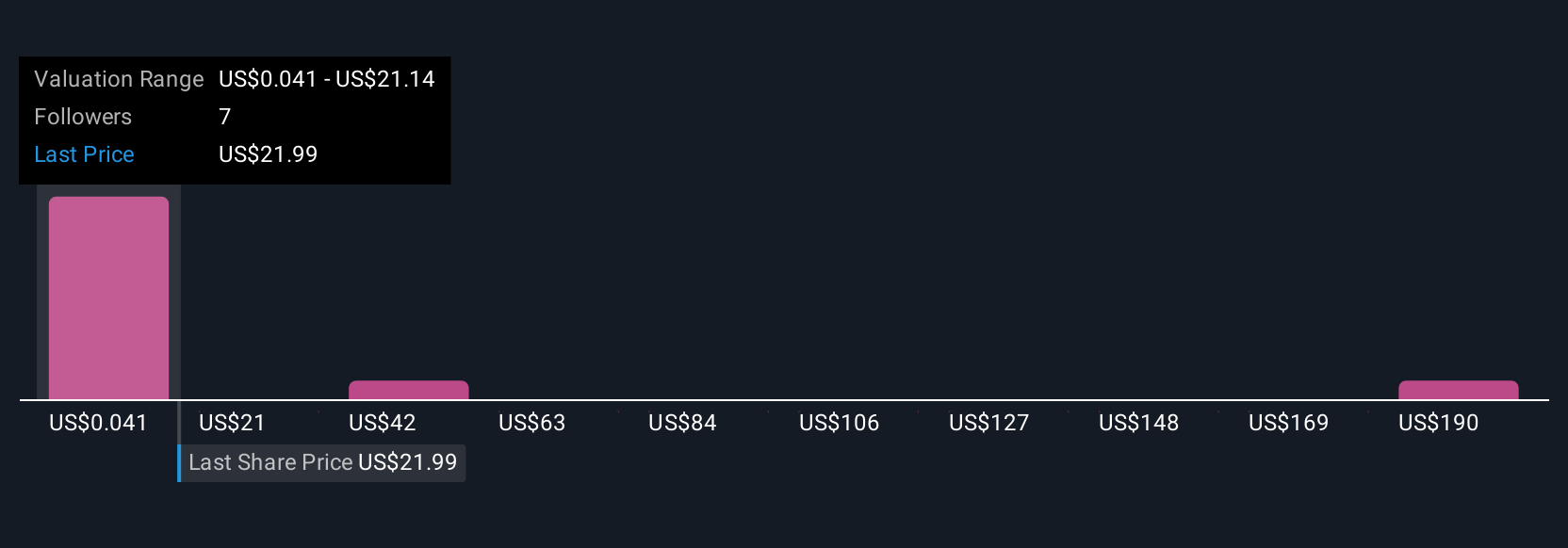

Despite retreating, SharpLink Gaming’s shares might still be trading 25% above their fair value.Discover the potential downside here.

Exploring Other Perspectives

The Simply Wall St Community has contributed 19 distinct fair value estimates for SharpLink Gaming, with projections ranging from a few cents to over US$60,000 per share. Such a very large spread in opinions means some see extreme undervaluation, while others foresee significant downside. Compare these perspectives with the recent blockchain-focused pivot, and you’ll want to consider how sharply risk profiles can change for companies like this.

Explore 19 other fair value estimates on SharpLink Gaming – why the stock might be worth less than half the current price!

Build Your Own SharpLink Gaming Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes – extraordinary investment returns rarely come from following the herd.

- A great starting point for your SharpLink Gaming research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free SharpLink Gaming research report provides a comprehensive fundamental analysis summarized in a single visual – the Snowflake – making it easy to evaluate SharpLink Gaming’s overall financial health at a glance.

Curious About Other Options?

Our top stock finds are flying under the radar-for now. Get in early:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Search

RECENT PRESS RELEASES

Related Post