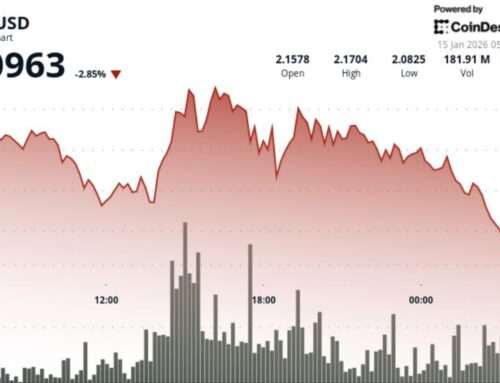

Why Strategy (MSTR) Is Down 5.7% After Pivoting From Bitcoin Buying To Building A Cash Buf

December 23, 2025

-

In recent days, Strategy Inc. paused its aggressive Bitcoin purchases and instead raised about US$748 million via common stock sales, lifting its U.S. dollar reserve to roughly US$2.19 billion to cover dividends and debt without liquidating crypto holdings.

-

This shift from constant Bitcoin accumulation to building a sizeable cash buffer marks a material change in how Strategy balances crypto exposure with liquidity and index-related risks.

-

We’ll now examine how this move to prioritize a larger cash reserve over immediate Bitcoin buying reshapes Strategy’s investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

To own Strategy today you still have to buy into the idea that this is effectively a leveraged Bitcoin operating company, not a conventional software stock, with earnings driven far more by BTC mark‑to‑market than Mosaic’s modestly growing revenue. The main short term catalysts remain Bitcoin price moves, the looming MSCI index decision and access to fresh capital, while recent underperformance versus both the market and software peers shows how painful that linkage can be on the downside. The decision to pause BTC buying and lift the USD reserve to roughly US$2.19 billion is material, because it reduces near term refinancing and dividend stress, directly addresses concerns about forced Bitcoin sales and partially reframes the story around balance sheet resilience instead of pure accumulation, even as dilution and index‑exclusion risk stay front and center.

However, the dilution required to build that “safety net” is something investors should not ignore. Our valuation report here indicates Strategy may be undervalued.

Eight fair value estimates from the Simply Wall St Community cluster between about US$490 and US$705 per share. That spread sits against a business whose biggest near term swing factor is still Bitcoin, even after the recent move to shore up more than US$2.19 billion of cash, which could change how quickly any BTC rally or setback flows through to shareholders. Readers can weigh those contrasting views alongside the evolving balance between crypto exposure and liquidity.

Explore 8 other fair value estimates on Strategy – why the stock might be worth over 4x more than the current price!

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

-

A great starting point for your Strategy research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

-

Our free Strategy research report provides a comprehensive fundamental analysis summarized in a single visual – the Snowflake – making it easy to evaluate Strategy’s overall financial health at a glance.

Terms and Privacy Policy

Search

RECENT PRESS RELEASES

Related Post