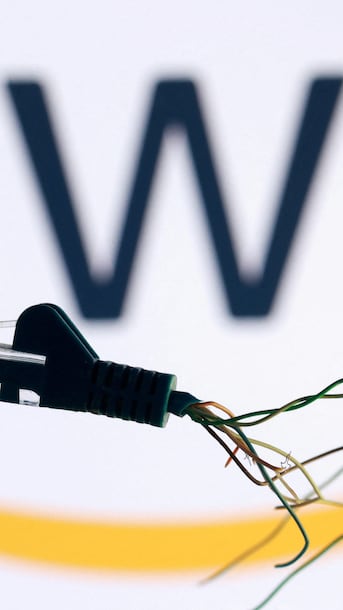

Why the AWS outage exposed the risks of depending on a single company

October 23, 2025

A few days after Amazon’s cloud services company AWS had an outage that plunged millions of popular websites and apps into the dark, questions still linger about why we’re so reliant on a handful of companies in the first place — and why it might be hard to prevent another outage.

Reminiscent of last year’s CrowdStrike outage and the Rogers outage of 2022, Monday’s disruption demonstrated just how many corners of the economy are dependent on a single company.

Snapchat, Pinterest, Reddit and Spotify went dark. The Starbucks app — along with DoorDash and Grubhub — struggled to take food and drink orders, and the Lyft app had trouble connecting drivers with riders. Some Venmo users couldn’t transfer money, and some Zoom users couldn’t make video calls.

Streaming services like Netflix, Disney+ and Amazon’s own Prime Video were affected, and messaging services WhatsApp and Signal had issues. U.K. government websites stopped loading properly, as did some of the platforms used by its National Health Service.

As Atlantic writer Will Gottsegen put it, tech outages happen — “but under our current system, a bad day for Amazon can be a bad day for everyone.”

And the current system is one in which AWS captured nearly a third of the global cloud services market during the second quarter of this year, with Microsoft Azure and Google Cloud not far behind. Together, these three companies own more than 60 per cent of the cloud market.

So how do companies balloon to capture large swaths of a particular market?

There are several ways, say experts who spoke with CBC News. While some companies may be early innovators that naturally outpace their competitors, many of the world’s largest firms have been accused of or investigated for using anti-competitive measures to stay on top.

Success creates ‘snowballing effect’

This past July, the U.K.’s antitrust regulator published a report alleging that AWS’s large stake in the country’s cloud services market was harming competition and recommended it for investigation. Parent company Amazon pushed back, saying the report disregarded “clear evidence of robust competition.”

Amazon was also accused several years ago of maintaining monopoly power in the United States through deceptive practices related to its Prime service. The company didn’t admit fault, saying that Amazon and its executives “have always followed the law,” but agreed to settle the case with a landmark $2.5-billion US deal this year.

When market power rests with a single company (a monopoly) or is dispersed between a small number of companies (an oligopoly), that can “create a brittleness in our economy and a lack of resiliency,” said Robin Shaban, co-founder and chair of the Canadian Anti-Monopoly Project.

Some companies that operate in the digital realm — such as ridesharing apps or social media platforms — grow quickly because they have “unique characteristics that make them more valuable the more people use them,” Shaban said.

“The platform is more useful the more users there are, the more accounts you have. And so it creates this snowballing effect,” Shaban said. “The market becomes dominated by one company because that is the most effective way for that company to make profit.”

Supersized businesses can also develop from a merger between two large companies or from “killer acquisitions,” the latter describing instances when a big company buys smaller companies that could otherwise become major competitors, Shaban said.

Several markets in Canada are cornered by a few big companies, including groceries, airlines and banking. But too much competition — especially without consumer demand — can create a cutthroat environment that isn’t sustainable or profitable for businesses in the long term.

“Oligopoly, monopoly and cutthroat competition are two ends of a very long spectrum. And there’s lots of space to manoeuvre along that spectrum,” Shaban said, noting that public policy needs to reflect those market dynamics.

‘No optimal number’ of competitors

However, big isn’t necessarily bad, and companies are even allowed to dominate markets, said Vass Bednar, managing director of the Canadian SHIELD Institute, a public policy think-tank focused on sovereignty, and co-author of The Big Fix: How Companies Capture Markets and Harm Canadians.

“Robust markets are about more than just counting the number of competitors…. There’s no optimal number,” Bednar said.

“But if we ignore realities of how firms are competing or how they’re structured, how they’ve evolved over time, then those conversations around things like barriers to entry or getting a new entrant to the marketplace are really difficult.”

Amazon’s cloud services unit (AWS) says it is recovering from a roughly three-hour widespread outage on Monday that disrupted businesses around the world. The services affected include several popular websites, apps and major banks.

Some companies — especially those that establish themselves as “everything” companies, with tentacles reaching across different sectors and along the supply chain — might grow because they use one branch of their business to financially offset other parts of it, Bednar said.

That can also help them “significantly undercut rivals with the goal of extinguishing them, either getting them out of the marketplace, or depreciating their value and then acquiring them because, as a company, they’re not any one thing,” she said.

They might also use a strategy called “vertical integration” — in which they control multiple parts of their supply chain, rather than outsourcing that work to another firm.

Do protections exist?

Several Canadian companies were directly or indirectly impacted by the AWS outage on Monday, including wealth management platform Wealthsimple, which said it was having technical issues, and the Toronto Blue Jays, which said some fans were having trouble buying tickets after Ticketmaster was disrupted by the outage.

Jennifer Quaid, a full professor in the civil law section at the University of Ottawa’s law faculty, said outages are likely inevitable and that the question to ask is: “What measures are in place to ensure that there are not terrible or catastrophic consequences when that happens?”

Certain sectors of the economy have been deemed too important for failure, Quaid said, which is when redundancies are built into those sectors: backup infrastructure that isn’t necessary for everyday functioning but can kick in when the primary infrastructure fails.

“That happens in the nuclear industry, for example. You just can’t have the safety fail,” she said.

In a report last year, the Canadian Radio-television and Telecommunications Commission said that the 2022 Rogers outage might have been prevented had the company’s systems not lacked certain redundancies. It has since made changes to address the root cause of the outage, the regulator said.

An Amazon Web Services outage took down huge swaths of the internet, from Snapchat to Fortnite to Netflix to Venmo. Is it time for Canada to rethink its digital infrastructure?

In the case of something like AWS, “you would have to identify the parts of the internet or the types of uses of the internet that would be considered so critical that there would have to be backups or some kind of sharing mechanism with the other providers,” Quaid said.

When it comes to shielding Canadian consumers from the vulnerabilities of foreign-owned infrastructure, “we don’t have protections for that,” Bednar said.

However, she said, “we’re much more alive to that interdependence now, how that interdependence has been weaponized, and much more motivated to invest more in digital infrastructures here at home.”

Search

RECENT PRESS RELEASES

Related Post