Why the Next Quarter Could Be the ‘Best Ever’ for Apple Stock

November 3, 2025

Apple’s (AAPL) guidance for the December quarter could be the company’s strongest period ever, driven by a robust iPhone refresh cycle. The hardware giant forecasts revenue to grow between 10% and 12% year-over-year (YoY) in the holiday quarter. In fiscal Q1 of 2025 (ended in December), Apple reported sales of $124.3 billion. At the midpoint estimate, Apple’s sales are forecast to grow to $138 billion in Q1 of 2026, above consensus estimates of $132.3 billion.

Citi analyst Atif Malik highlighted the record-breaking nature of this upgrade cycle, noting customers are flooding in from all previous iPhone generations. The analyst emphasized that the rate of upgrades and the total number of upgrading customers are rising simultaneously, while brand-new customers continue to enter the Apple ecosystem, which is quite sticky.

Features like the advanced camera system and ultra-thin iPhone Air design are driving consumer enthusiasm, while CEO Tim Cook attributed the bullish outlook to “off-the-chart” demand for iPhone 17 devices and increased store traffic globally.

Several iPhone 17 models remain supply-constrained, which indicates that demand is outpacing the company’s ability to manufacture devices. Apple also estimates that growth in China will turn positive in fiscal Q1, following a 4% decline in Q4.

In the quarter ended in September, Apple reported revenue of $102.47 billion, an increase of almost 9% YoY. Services sales rose by 15% to $29 billion, while Mac sales increased by 13%. Citi raised the price target for AAPL stock from $245 to $315, indicating an upside potential of 16% from current levels.

Services Key to Apple’s Long-Term Growth

The installed base of active devices reached all-time highs across every product category and geographic segment, providing a massive foundation for future services revenue growth and hardware upgrades.

As stated earlier, Services sales rose 15% to $29 billion, which is an all-time record for the iPhone maker. The high-margin business showcased strength with double-digit growth across most categories and markets.

Payment services reached an all-time revenue record, driven by double-digit growth in Apple Pay active users. For the full fiscal year, Services generated over $100 billion in annual revenue, representing a 14% YoY increase.

Customer satisfaction metrics remain strong at 98% for iPhone in the United States, 96% for Mac, and 98% for iPad, according to recent surveys. These loyalty levels translate directly into repeat purchases and ecosystem expansion. The installed bases of both the Apple Watch and AirPods reached new all-time highs, while over 50% of customers purchasing an Apple Watch during the quarter were new to the product.

Notably, enterprise adoption continues to expand rapidly across industries. BMW (BMWKY) deployed tens of thousands of iPhones to factory employees, Capital One (COF) added thousands more MacBook Airs, and Purdue University launched a spatial computing hub around Vision Pro. These institutional deployments create sticky, long-term revenue streams.

Apple’s manufacturing investments are paying off with a new Houston facility producing servers for Apple Intelligence, which has just begun production. The company committed to $600 billion in U.S. investments over four years, focusing on advanced manufacturing, silicon engineering, and artificial intelligence, which is expected to support over 450,000 jobs while building competitive advantages in strategic technologies.

Is AAPL Stock Still Undervalued?

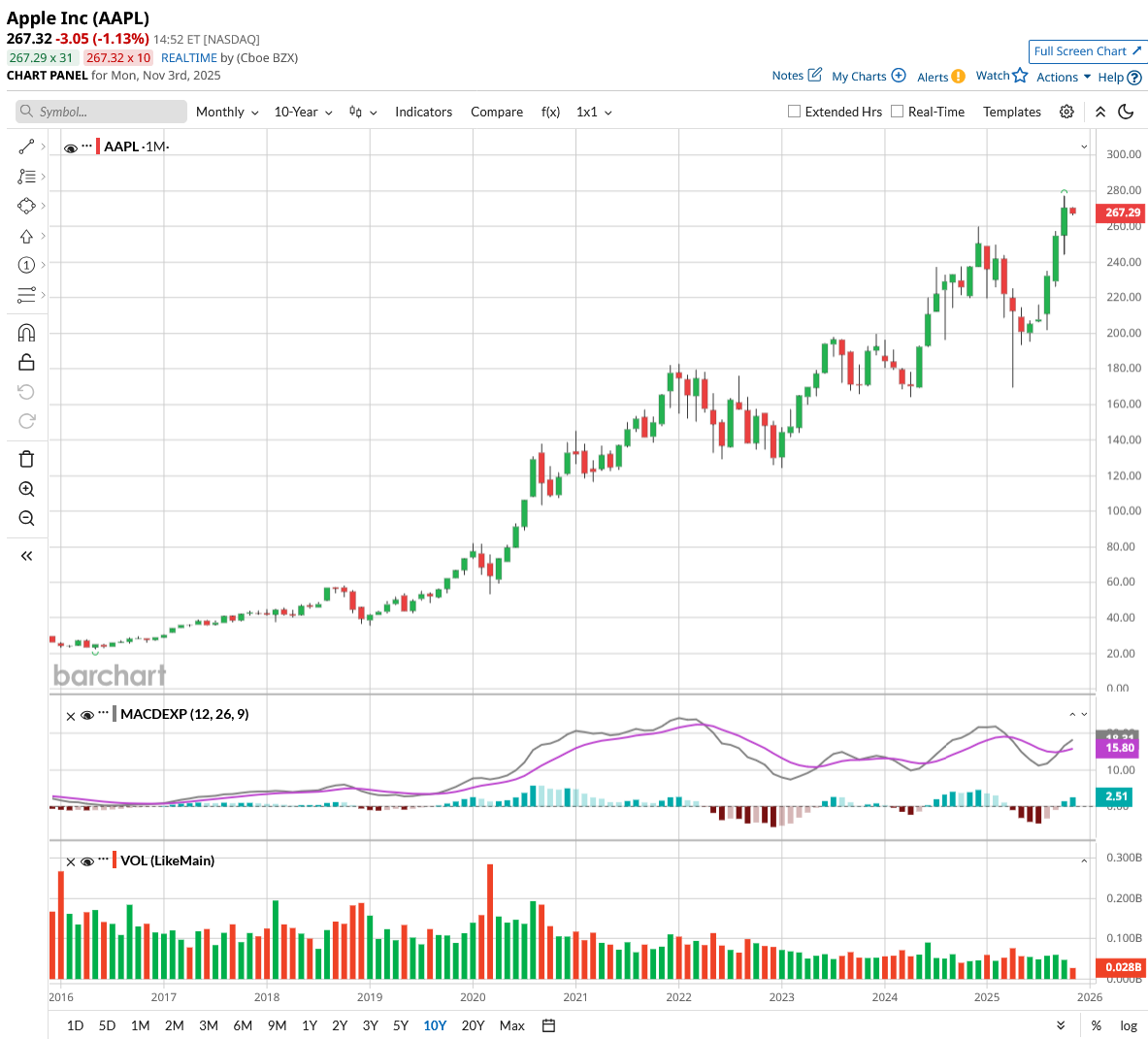

Valued at a market cap of $4 trillion, AAPL stock has returned 20% in the last 12 months and is up over 900% in the past decade, after adjusting for dividend reinvestments. Analysts tracking AAPL stock forecast revenue to increase from $416.16 billion in fiscal 2025 to $577 billion in fiscal 2030. In this period, adjusted earnings are forecast to expand from $7.46 per share to $13.77 per share.

Today, AAPL stock trades at a forward earnings multiple of 32.8x, above its 10-year average of 22.2x. If the tech giant reverts to its historical mean, it could gain less than 15% over the next four years.

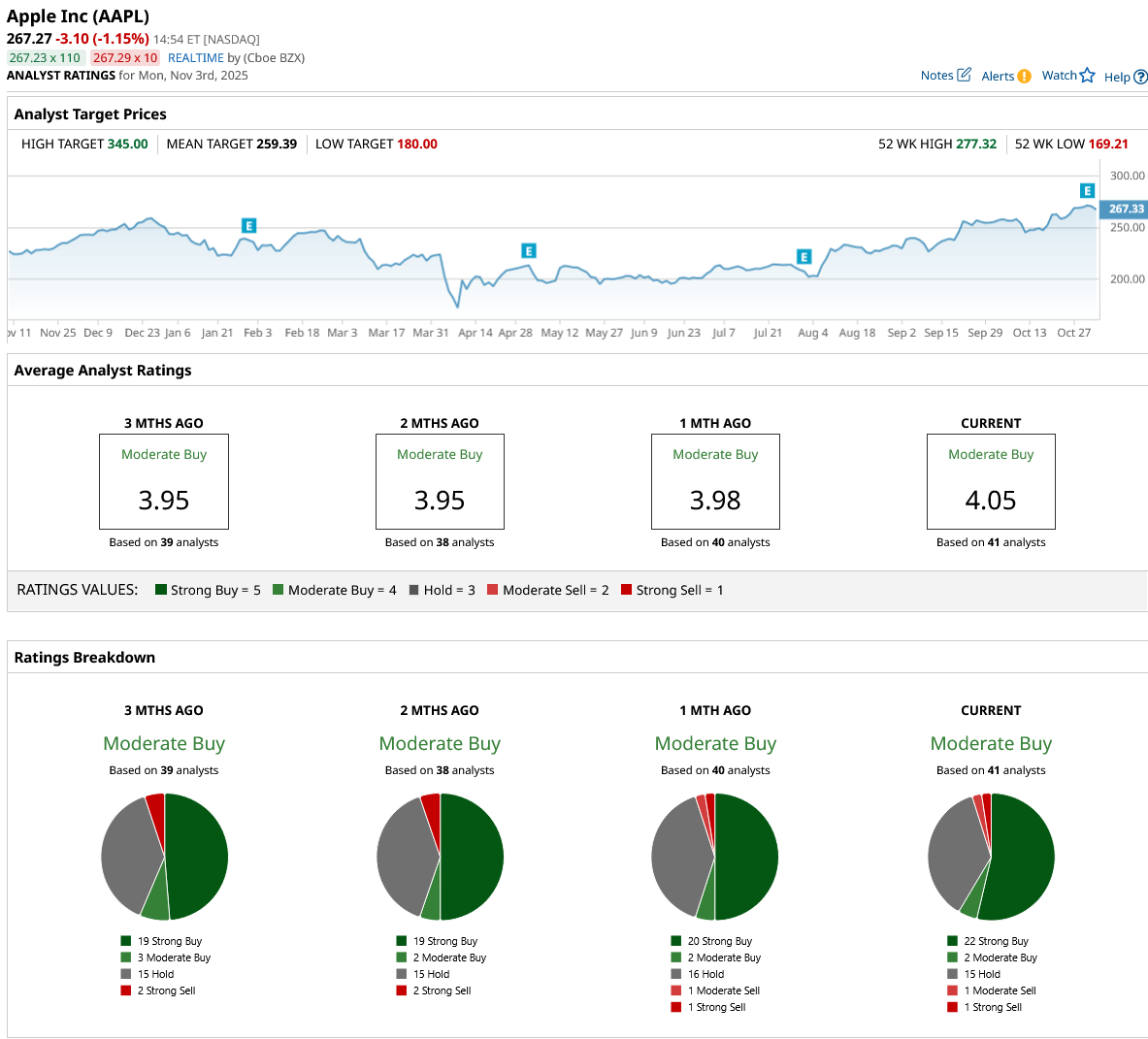

Out of the 41 analysts covering AAPL stock, 22 recommend “Strong Buy,” two recommend “Moderate Buy,” 15 recommend “Hold,” one recommends “Moderate Sell,” and one recommends “Strong Sell.” The average AAPL stock price target is $259.39, below the current price of $271.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Amazon Is Lifting Cipher Mining Stock. Is There More Upside in Store?

- The Future Is Now as This New Drone ETF Takes Flight

- Dear Kenvue Stock Fans, Mark Your Calendars for November 6 Upcoming earnings

- Amazon Is Giving Marvell Technologies Stock a Huge Boost. Why, and Should You Buy MRVL Here?

Search

RECENT PRESS RELEASES

Related Post