Will Accelerating AWS Revenue Growth Drive AMZN Stock’s 2026 Rally?

January 9, 2026

Amazon‘s AMZN cloud computing division has emerged from its growth slowdown, posting its strongest quarterly performance in nearly three years and positioning the e-commerce giant for an AI-driven rally in 2026. With cloud infrastructure investments accelerating, new AI services launching, and forward guidance signaling sustained momentum, Amazon appears poised to capitalize on the enterprise AI transformation that’s reshaping the technology landscape.

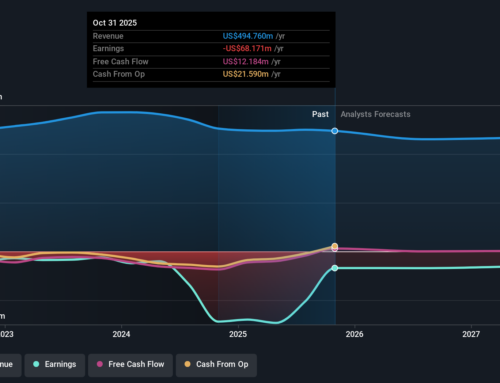

The Zacks Consensus Estimate for AMZN’s 2026 earnings is pegged at $7.85 per share, which indicates a jump of 9.46% from the year-ago period.

Amazon.com, Inc. price-consensus-chart | Amazon.com, Inc. Quote

Amazon Web Services (“AWS”) delivered $33 billion in third-quarter revenues, marking a robust 20.2% year-over-year expansion that represents the division’s highest growth rate in 11 quarters. This reacceleration validates the company’s massive infrastructure buildout strategy, as CEO Andy Jassy noted that AWS is experiencing demand levels not seen since 2022. The cloud segment generated $11.4 billion in operating income during the quarter, demonstrating its ability to maintain profitability while scaling capacity to meet surging AI workload requirements.

The company’s fourth-quarter guidance projects total revenues between $206 billion and $213 billion, representing growth of 10% to 13%, with operating income expected to reach $21 billion to $26 billion. This outlook reflects management’s confidence heading into the critical holiday period and early 2026, particularly as enterprises continue migrating legacy infrastructure to the cloud while simultaneously deploying generative AI applications. Amazon’s cloud backlog reached $200 billion by quarter-end, providing substantial revenue visibility for the coming years and underscoring the durability of customer demand across both traditional cloud services and emerging AI workloads.

Amazon’s AWS re:Invent conference in early December 2025 showcased a comprehensive suite of AI and cloud innovations that strengthen its competitive positioning for 2026. The company introduced Graviton5, its most powerful and efficient CPU to date, delivering improved price-performance for broad workload categories. Trainium3 UltraServers, powered by the company’s 1st 3-nanometer AI chip, became available to help organizations run ambitious AI training and inference workloads faster and at lower cost.

On the software front, Amazon launched new Amazon Bedrock AgentCore capabilities to power the next wave of agentic AI development, enabling customers to build more sophisticated AI agents. The Nova model family expansion introduced both Nova Forge for organizations building custom models and Nova Act for creating agents, while Amazon Bedrock’s new reinforcement fine-tuning feature delivers 66% accuracy gains on average over base models. The company also introduced frontier agents, representing a new class of AI agents that function as extensions of software development teams.

WS Transform launched with agentic capabilities enabling rapid modernization of legacy code and applications. Amazon S3 Vectors reached general availability in January 2026, increasing per-index capacity to 2 billion vectors and introducing a storage-first architecture that reduces total cost of ownership by up to 90% for large-scale retrieval-augmented generation workloads.

Amazon deployed $34.2 billion in capital expenditures during the third quarter, bringing spending to $89.9 billion as of the end of the third quarter. Management expects full-year 2025 capital expenditures to reach approximately $125 billion, with plans to increase that amount further in 2026. The vast majority of these investments target revenue-generating equipment for AWS data centers, including AI infrastructure and custom silicon development like Trainium chips. The company added more than 3.8 gigawatts of power capacity over the past 12 months, with ambitions to double total capacity by 2027.

This aggressive capacity expansion reflects management’s conviction that AI represents a massive opportunity with strong potential returns on invested capital over the long term. The company has already seen 150% quarter-over-quarter growth in its custom chip business, with Trainium2 chips fully subscribed and generating a multi-billion-dollar business.

Amazon shares have returned 12.8% over the past year, outperforming the broader Zacks Retail-Wholesale sector. This creates an attractive entry point for investors seeking cloud exposure heading into 2026, particularly as AWS growth momentum builds on the back of massive infrastructure investments.

Image Source: Zacks Investment Research

Amazon’s price-to-earnings ratio of 31.21x represents a significant premium to the Zacks Internet Commerce industry average of 25.22x, though it remains well below the company’s five-year historical average of 51.51x, suggesting room for multiple expansion as AWS growth continues re-accelerating. The stock carries a Value Score of D.

Image Source: Zacks Investment Research

In the competitive cloud infrastructure landscape, Amazon maintains its market leadership position despite facing intensifying pressure from rivals. Alphabet GOOGL-owned Google Cloud delivered 34% year-over-year growth in the third quarter, while Microsoft MSFT Azure recorded 40% expansion, both outpacing Amazon’s 20% AWS growth rate. However, Amazon’s $33 billion quarterly AWS revenues significantly exceed Google Cloud’s $15.2 billion and represent a commanding share of the total cloud market. Oracle ORCL has emerged as a fast-growing challenger, with its cloud infrastructure revenues surging 49% to $2.7 billion, though it remains substantially smaller than the hyperscale leaders. The competitive dynamics favor Amazon, given its comprehensive AI infrastructure stack, extensive global footprint, and established enterprise relationships across industries.

AWS’ 20.2% growth reacceleration, combined with $125 billion in infrastructure investments and comprehensive AI service launches, positions Amazon for sustained outperformance in 2026. The $200 billion cloud backlog provides revenue visibility, while the stock’s valuation below historical averages offers compelling upside potential for long-term investors. AMZN currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Oracle Corporation (ORCL) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Terms and Privacy Policy

Search

RECENT PRESS RELEASES

Related Post