Will Nebius Group’s (NBIS) Meta Deal Accelerate Its Shift From Growth to Profitability?

November 15, 2025

- Nebius Group recently announced a multi-year, US$3 billion AI infrastructure agreement with Meta, alongside the launch of new AI offerings such as Nebius Token Factory, following its first UK deployment of NVIDIA Blackwell Ultra AI infrastructure and third quarter earnings results showing very large year-on-year revenue growth to US$146.1 million and a net loss of US$119.6 million.

- These developments reinforce Nebius’s rapid expansion and positioning as a key player in cloud-based AI infrastructure, underlining its strengthening partnerships with leading technology providers and its push into global enterprise markets.

- We will explore how Nebius Group’s expanded partnership with Meta and product innovations could shape its investment narrative going forward.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

Advertisement

Nebius Group Investment Narrative Recap

At the heart of the Nebius Group investment case is the belief that explosive demand for AI infrastructure will translate into sustained top-line growth, but the company’s latest follow-on equity offering may impact the near-term catalyst of margin expansion by injecting potential share dilution risk. While blockbuster revenue growth and the Meta agreement affirm Nebius’s position as an AI infrastructure provider, the large Q3 net loss and new equity raise underscore that capital needs remain the biggest business risk short term, with limited impact on the underlying long-term demand narrative.

Of recent news, Nebius Group’s new US$3 billion multi-year partnership with Meta stands out most. This agreement showcases Nebius’s increasing relevance among top-tier enterprise customers and could play an important role in supporting its strategy to ramp revenue, increase contract visibility, and mitigate some risks associated with geographic and industry concentration.

But as Nebius accelerates expansion, investors should also watch for potential impacts of continued share dilution and…

Read the full narrative on Nebius Group (it’s free!)

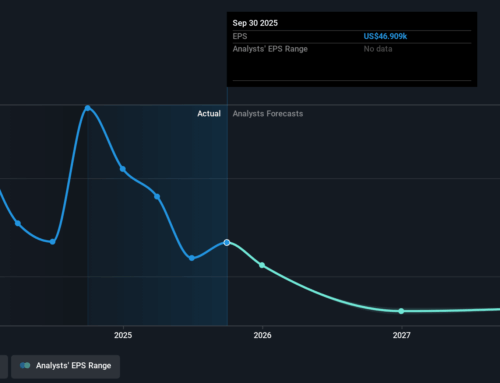

Nebius Group’s narrative projects $3.2 billion in revenue and $428.7 million in earnings by 2028. This requires 133.9% yearly revenue growth and an earnings increase of $238.5 million from current earnings of $190.2 million.

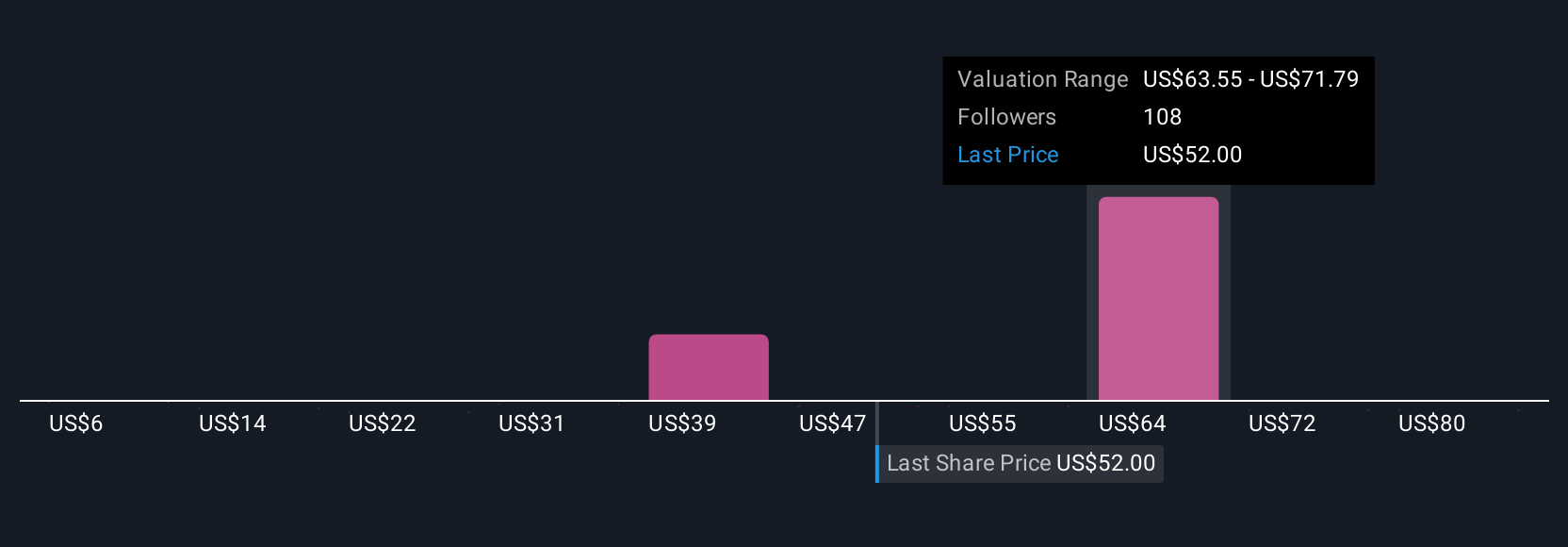

Uncover how Nebius Group’s forecasts yield a $166.00 fair value, a 99% upside to its current price.

Exploring Other Perspectives

Private valuations for Nebius Group by 36 Simply Wall St Community members range from US$9.17 to US$176.90 per share. With recent rapid growth drawing both excitement and concern, many are watching how Nebius manages capital needs amid ongoing equity offerings, explore how these different views could shape your outlook below.

Explore 36 other fair value estimates on Nebius Group – why the stock might be worth over 2x more than the current price!

Build Your Own Nebius Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nebius Group research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Nebius Group research report provides a comprehensive fundamental analysis summarized in a single visual – the Snowflake – making it easy to evaluate Nebius Group’s overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won’t stay hidden for long. Get the list while it matters:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Nebius Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Search

RECENT PRESS RELEASES

Related Post