Will Plug Power’s (PLUG) Renewable Fuels Expansion Redefine Its Clean Energy Strategy?

October 27, 2025

- Plug Power Inc. recently announced a partnership with Edgewood Renewables to develop a renewable fuel facility in North Las Vegas, Nevada, producing sustainable aviation fuel, renewable diesel, and biomethanol from waste biomass feedstocks using renewable natural gas and low-carbon hydrogen.

- This collaboration marks Plug Power’s entry into renewable fuels beyond hydrogen, broadening its clean-energy portfolio while highlighting both its engineering expertise and the sector’s focus on transportation decarbonization.

- To understand the implications for Plug Power’s investment narrative, we’ll examine how entering renewable fuels with Edgewood Renewables could influence its prospects.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Advertisement

Plug Power Investment Narrative Recap

To be a Plug Power shareholder, you need to believe in the mainstream adoption of green hydrogen and renewable fuels, and trust that the company can execute on major projects while controlling costs. The recent partnership with Edgewood Renewables highlights Plug’s potential to broaden its technology base, but in the short term, liquidity remains the key catalyst and the biggest risk, with this announcement not shifting the urgent need to manage cash burn and funding requirements.

Of recent announcements, Plug Power’s successful deployment of its GenDrive fuel cell systems and GenFuel infrastructure at Floor & Decor’s Washington facility is the most tangible indicator of commercial traction in its core hydrogen solutions business. As Plug expands into renewable fuels with Edgewood, its ability to scale proven hydrogen applications and secure recurring revenue contracts remains central to supporting future growth and margin improvement.

However, investors should be aware that, despite high-profile partnerships, Plug Power’s short cash runway and significant ongoing losses mean…

Read the full narrative on Plug Power (it’s free!)

Plug Power’s narrative projects $1.2 billion revenue and $124.7 million earnings by 2028. This requires 22.2% yearly revenue growth and a $2.1 billion increase in earnings from the current -$2.0 billion.

Uncover how Plug Power’s forecasts yield a $2.78 fair value, a 6% downside to its current price.

Exploring Other Perspectives

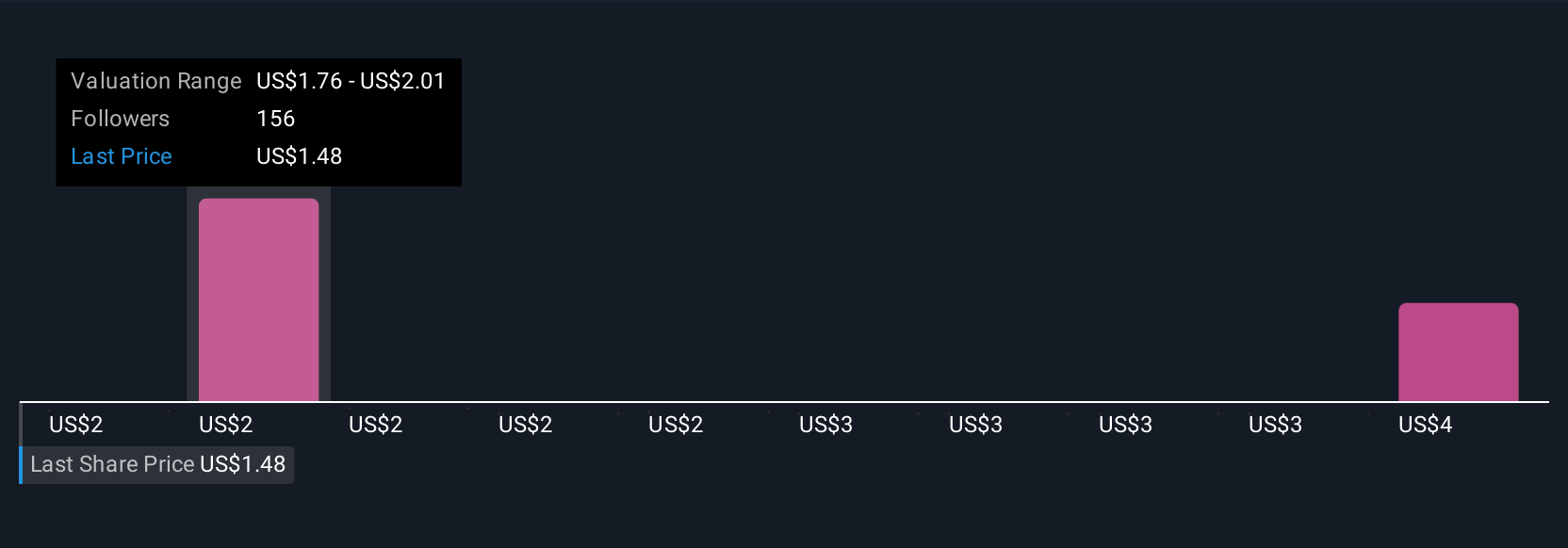

Twenty Simply Wall St Community fair value estimates for Plug Power cover a wide range from US$1.52 to US$7.20. With the company’s persistent cash burn and profitability risks, you can see how opinions can vary on future performance, so consider multiple viewpoints before acting.

Explore 20 other fair value estimates on Plug Power – why the stock might be worth 48% less than the current price!

Build Your Own Plug Power Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

- A great starting point for your Plug Power research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Plug Power research report provides a comprehensive fundamental analysis summarized in a single visual – the Snowflake – making it easy to evaluate Plug Power’s overall financial health at a glance.

Seeking Other Investments?

Don’t miss your shot at the next 10-bagger. Our latest stock picks just dropped:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Search

RECENT PRESS RELEASES

Related Post