Will Rising Selling Delay Ethereum Golden Cross Even As Price Nears $2,500?

June 26, 2025

Ethereum has recently recovered from a monthly low, sparking renewed hope for profit. As a result, short-term holders (STH) are likely moving their holdings to exchanges to capitalize on Ethereum’s rise.

This increase in selling activity has brought the potential for a Golden Cross into question, as the market shows signs of strain from growing selling pressure.

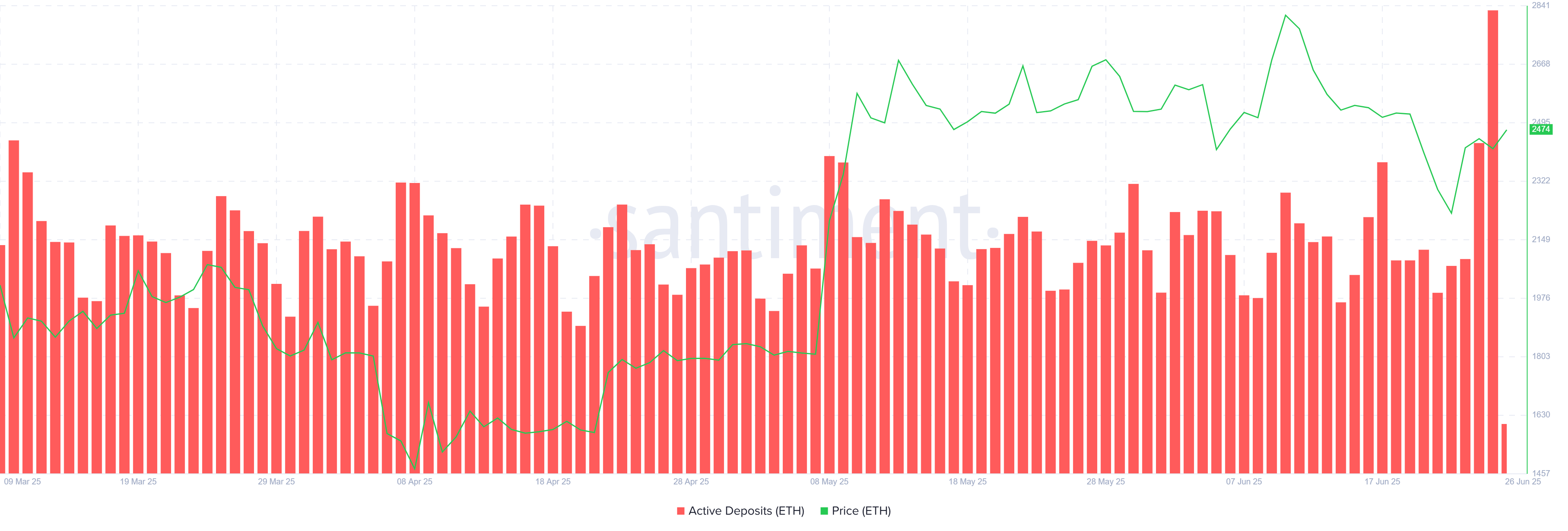

Active deposits on Ethereum’s network have seen a significant uptick over the last 24 hours, reaching a five-month high. This surge in deposits signals that investors, particularly short-term holders, are eager to book profits from Ethereum’s recent price increase. These are short-term holders likely capitalizing on the altcoin’s gains this week.

Despite the increase in potential selling activity from STHs, the long-term holders (LTHs) are not actively selling since the Coin Days Destroyed (CDD) metric does not note any uptick. This suggests that LTHs are holding onto their Ethereum, and the selling pressure is primarily coming from short-term investors.

Additionally, Ethereum is on the brink of a potential Golden Cross, a technical indicator often seen as a bullish signal. The altcoin has been closely monitored for this crossover, which typically indicates that the market is shifting toward a sustained uptrend. However, the recent surge in selling activity could delay or even jeopardize this Golden Cross, as selling pressure may undermine Ethereum’s upward trajectory.

The Golden Cross, which could signal the end of the prolonged Death Cross that has persisted for the last four months, may take longer to materialize if this selling activity continues. The market remains in a delicate balance, with the Death Cross still looming while Ethereum attempts to recover.

Ethereum’s price is currently up 11% this week, trading at $2,473 at the time of writing. The altcoin is attempting to flip the $2,476 resistance into support to solidify the recent gains. Securing this level would be critical for Ethereum to maintain its current upward trajectory and build investor confidence in the short term.

However, if the rising deposits from short-term holders turn into active selling, Ethereum could see a drawdown. A failure to maintain upward momentum could pull Ethereum back to $2,344 or even lower to $2,205. This potential decline would reverse the current gains and pose a significant threat to the altcoin’s bullish outlook.

On the other hand, if Ethereum successfully flips $2,476 into support and the selling pressure subsides, the altcoin could push past $2,606. A break above this level would set Ethereum on a course to test $2,681, which would help invalidate the bearish thesis and signal further price growth. This scenario could mark a strong recovery for Ethereum.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Search

RECENT PRESS RELEASES

Related Post