Workday’s AI Push and Elliott’s Stake Might Change the Case for Investing in WDAY

September 21, 2025

- In recent days, activist investor Elliott Investment Management revealed a stake exceeding US$2 billion in Workday and praised the company’s management and transformation plan, shortly after Workday unveiled a multi-year operational overhaul with a focus on AI innovation, partnerships, and a new US$4 billion share repurchase program.

- An interesting insight is the scale and coordination of Workday’s announcements: alongside major AI product launches and new developer capabilities, the company deepened alliances with Microsoft, Databricks, Salesforce, and Snowflake, positioning itself at the center of the next phase of enterprise cloud adoption.

- We’ll examine how Workday’s significant AI-powered product expansions and ecosystem partnerships could influence its investment narrative and growth outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Advertisement

Workday Investment Narrative Recap

To own shares in Workday right now, you need confidence in the company’s ability to convert AI-driven HR and finance innovation, and a growing partner ecosystem, into sustained, profitable revenue growth. The recent US$2 billion investment by Elliott and Workday’s US$4 billion share repurchase program boost investor attention, but the most immediate catalyst remains Workday’s adoption and monetization of its new AI products, while the biggest risk continues to be intensifying competition from both startups and larger enterprise providers. News of this buyback signals management confidence but does not substantially shift near-term risk or reward.

Among Workday’s recent rollouts, the launch of Workday Build, a developer platform empowering customers and partners to create AI-powered solutions, directly supports the AI adoption thesis and extends Workday’s ecosystem, making it especially relevant to the company’s ambition to stay ahead as competition heats up.

On the other hand, investors should be keenly aware of mounting competitive risks from both emerging and established enterprise software challengers that could…

Read the full narrative on Workday (it’s free!)

Workday’s outlook calls for $12.9 billion in revenue and $1.8 billion in earnings by 2028. This projection is based on an annual revenue growth rate of 13.0% and an earnings increase of $1.2 billion from the current $583.0 million.

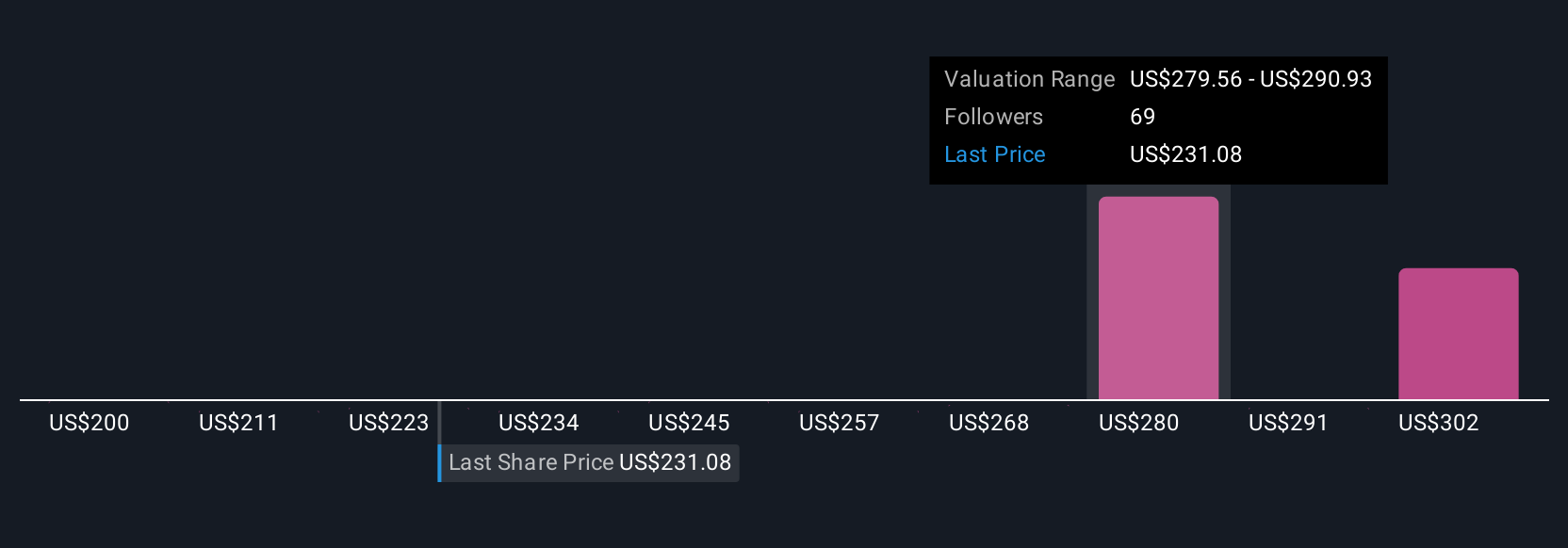

Uncover how Workday’s forecasts yield a $279.05 fair value, a 19% upside to its current price.

Exploring Other Perspectives

Twelve fair value estimates from the Simply Wall St Community span US$200 to US$324, showcasing a wide range of views on Workday. Many participants are focused on Workday’s ability to capitalize on accelerating demand for AI-powered enterprise solutions, which could influence longer-term growth outcomes.

Explore 12 other fair value estimates on Workday – why the stock might be worth 14% less than the current price!

Build Your Own Workday Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

- A great starting point for your Workday research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Workday research report provides a comprehensive fundamental analysis summarized in a single visual – the Snowflake – making it easy to evaluate Workday’s overall financial health at a glance.

Want Some Alternatives?

The market won’t wait. These fast-moving stocks are hot now. Grab the list before they run:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Workday might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Search

RECENT PRESS RELEASES

Related Post